July 8, 2022, Weekly Equity Market Recap. For the week, the Nasdaq closed up 4.6%, while the S&P 500 gained 1.9% and the Dow returning about 0.8%. Federal Chair Powell indicated either a 50 or 75 basis point interest rate hike is on the table during their late July meeting; however, most officials agreed that a 75-bp hike will be the most likely outcome. The Fed is hell bent on restraining inflation pressures which indirectly will keep financial assets down. However, with rising rates, the US dollar ended the week higher for the 11th time in the last 14 weeks.

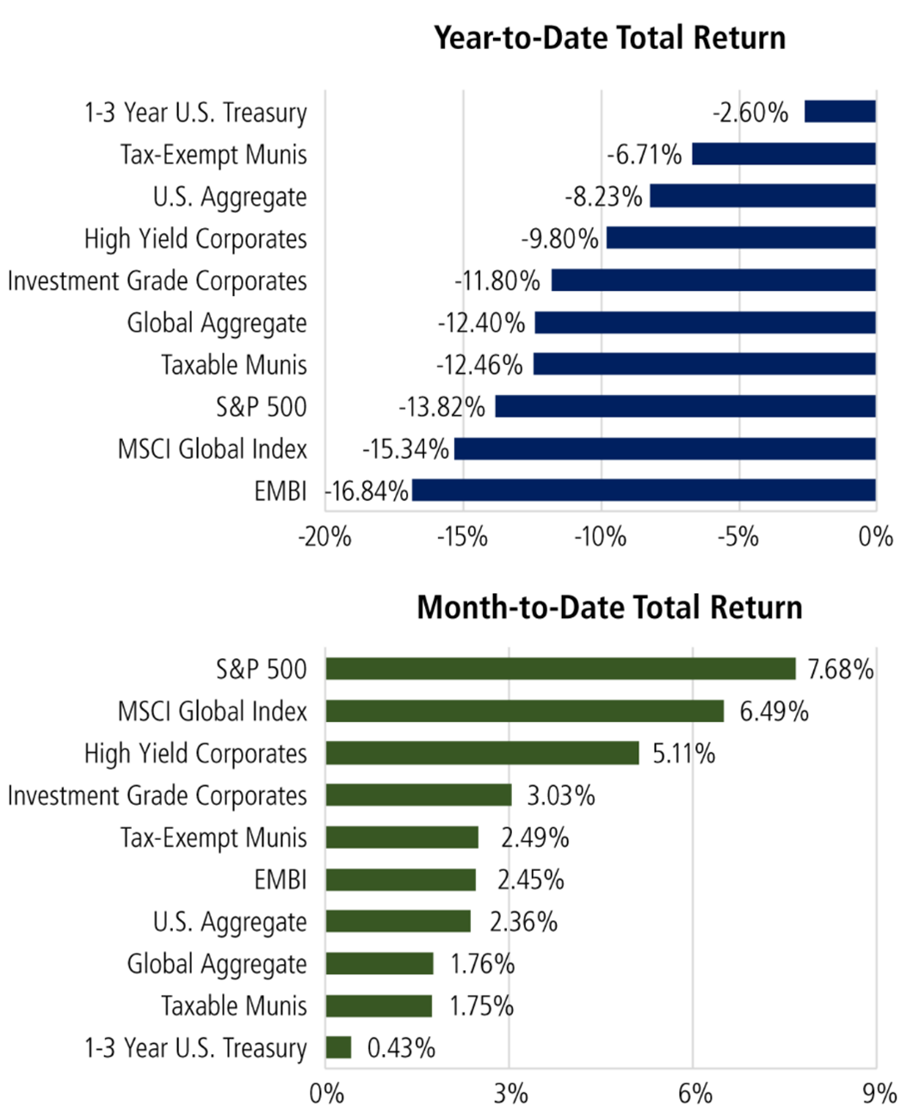

July 1, 2022, Weekly Equity Market Recap. Despite Friday’s gains, all of the major equity indexes posted their fourth down week: The S&P 500 finished down 2.2%, the Dow lower by 1.3% and the Nasdaq fell by 4.1%. S&P 500 posted a more than 16% second quarter loss, marking its biggest one-quarter fall since March 2020. The Dow Jones lost 11.3% in the second quarter, putting it down more than 15% for 2022, while the Nasdaq suffered its biggest quarterly drop since 2008, losing 22.4%. Investors remain focused on warning signs from several companies that lowered their profit guidance, adding to investor concerns that persistent inflation at decades long highs could continue to put pressure on share prices. The Institute for Supply Management showed that the month of June was weaker than expected with its index of national factory activity dropping to 53 for the month, the lowest reading since June 2020. Michael Burry of “The Big Short” recently warned that the upheaval in financial markets is only halfway through and that companies will see earnings decline next.