July 12, 2024, Weekly Stock Market Return Recap, by Kip Lytel CFA. All three major US equity indexes finished with gains for the week, led by Dow Jones with slightly more than 2%, followed by the S&P 500 nearly reaching a 1.5% gain, and the Nasdaq setting a new high with almost a 1% weekly gain. June also marked the second consecutive month of soft inflation readings, with the June Consumer Price Index (CPI) report showed core CPI eking up only 0.06% over the month. There are a number of positive factor inputs that are driving the positive returns for stocks in 2024:

- The GDPNow model estimate for real GDP growth (seasonally adj annual rate) in the 2Q 24 is 2.0% on July 10, up from 1.5% on July 3

- GDP growth in the United States is projected to be 2.6% in 2024

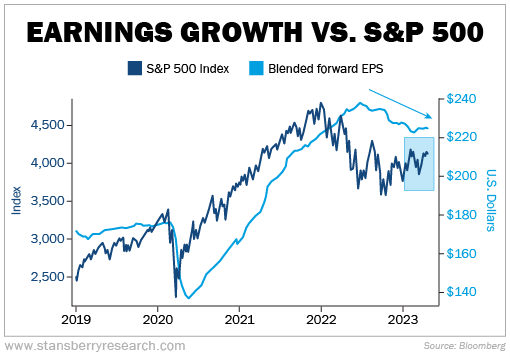

- SPX is expected to report Y/Y earnings growth of 8.8% for Q2 2024

- CY 2024, analysts are calling for (year-over-year) earnings growth of 11.0%

- Interest rate curve forward contracts show 90% chance Sept rate cut & second rate cut to November, with about even odds of a third rate cut by year's end

- S&P Dow Jones Indices expects S&P 500 companies to repurchase $885 billion in stock in 2024