-November 20, 2018 Capital Market Insights To Market Correction: We continue to maintain a cautious approach with diverse asset classes to manage risk. We subscribe to managing dynamic factor exposures while still delivering broadly diversified, economically representative portfolios. Given the diversity of our strategies, the far majority of our client portfolio loss exposure to the recent capital market retrenchment has been muted by our active management of risk, with about 0.40%-0.60% correlation. The equity market sell-off from last week has continued through Tuesday of this week with the S&P 500 and Dow Jones yearly gains now evaporated. Insofar as we have thought that many asset classes are priced on the high-side of fair, while others like tech leaders in the S&P 500 have been overvalued, our greatest concern continues to be on how the market will react to earnings deceleration in 2019. Thus, we think the financial media hype that this sell-off is more about energy doldrum (oil slumping), China and the Fed to be a couple degrees off target. Let’s revisit the math – if the S&P 500 earnings has been growing at +20% range for the quarterly basis and the forecast for 2019 is around +10%, then for all intents and purposes year-over-year quarterly growth is going to dramatically slow in 2019. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by GDP. However, we are in the camp that a +10% range growth in corporate earnings to be indicative of an overall healthy economic environment, and even a growth rate higher than the long-term norm. Thus, at this point, we will maintain our current portfolio risk posture and only look to make a more defensive change should there be new catalysts for concern. The fact is unemployment remains at 50 year lows, corporate earnings remain robust, consumer spending is powered-up, corporate stock buybacks add stock price support & capital investment is elevated. Looking at events from a historical basis, we don’t have the same excesses of past bear markets —especially in terms of leverage in investment products and the financial sector—that produced the global financial crisis in 2007 and 2008. Thus, we don’t see a replay of the 1930s or 2007 and 2008 at this time.

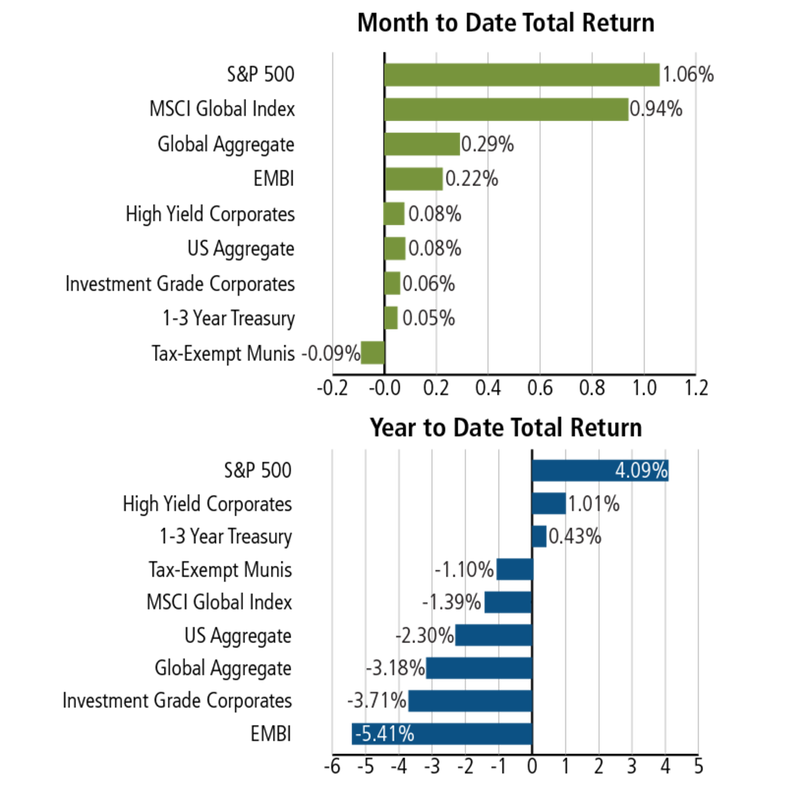

-November 16, 2018 Weekly Capital Market Update. All of the major indices fell for the week, the S&P 500® Index (-1.61%), the Dow Jones Industrial Average (-2.22%) and the Nasdaq (-2.15%). The U.S. equity markets were negatively impacted by some business hiccups of Tech leaders like Facebook (FB) and Apple (AAPL), along with other macro worries - falling oil prices, EU issues (Italy budget & Brexit), Fed rate increases & still some unresolved concerns with tariffs. One of the superior “directional” indicators of stock market performance is found in bonds because they trade based on fundamentals. In particular, high-yield bonds tend to be strong leading indicators of stock performance and that sector looks to be in good shape, with the treasury-to-junk bond spread holding steady. Also this week, two investment firms came out with updated market forecasts: 1) “While some incremental caution is likely warranted in 2019, our view is that portfolios should maintain a modestly pro-risk tilt,” the Charlie Himmelberg, chief markets economist and head of global markets research at Goldman Sachs and 2) Bank of America Merrill Lynch: "We believe that the holiday rally is underway." says their report. "October is known for sharp market declines, but also known for creating market lows that lift stocks into a year-end rally," they observe, adding, "Importantly, we believe the long-term trend in equity markets is higher."

-November 9, 2018 Weekly Capital Market Update. The major equity indices were positive for the week with the S&P 500 +2.13%, Dow Jones +2.84% and the Nasdaq +0.68%; investors were sanguine that legislative gridlock (via divided Congress) will provide a check on the Trump administration. Post-midterm results returned investor focus back to the home front where 78% of S&P 500 companies have beat EPS estimates for Q3 to date, marking the 2nd highest percentage since Factset began tracking this data back in 2008. Further, Factset’s data also indicates that fewer S&P 500 companies have discussed "tariffs" on earnings calls for Q3 relative to Q2, indicating that the economic impact of trade tensions could be overblown. Earnings growth expectations, however, are less robust as we look outward to 2019 where the EPS expectation is around 10% EPS growth. Finally, minutes of the Fed’s October Meeting revealed no significant changes in policy with the Fed signaling the next rate hike to occur in the month of December.

-November 6, 2018 Market Update. The mid-term elections came in as expected with Congress mixed as the Democrats regain control of the House as the Republicans gained additional seats in the Senate. However, mid-term elections have great historical significance that bodes well for the U.S. equity markets: Since 1946 every single mid-term election left stocks higher 12 months out, or more specifically the past 18 mid-term elections yielded positive returns for the stock market. With a mixed-controlled Congress the expectation is gridlock on many issues will make it challenging for Congress to spend money (that we don’t have) and the markets tend to like that scenario. However, Maxine Waters will now be the House Banking Committee Chair and that is a bit foreboding for Wall Street.

-November 2, 2018 Weekly Capital Market Update. All major equity indexes recovered lost ground for our U.S. markets as almost all sectors posted gains for the week, except for utilities. The S&P 500® Index returned +2.42%, the Dow Jones Industrial Average gained +2.36% and the Nasdaq finished up +2.65%. The positive catalyst for the equity market upturn were strong corporate earnings, job gains and renewed prospects of resolving the US-China trade tariff dispute; Trump reportedly asked key U.S. officials to begin drafting potential terms for an agreement to halt the escalating conflict. Furthermore, some corporate CEOs announced an increase in their corporate stock buyback program to take advantage of significantly undervalued prices and this news partly contributed to the market recovery. Insofar as the U.S. economy still looks healthy and economists don't foresee any near-term recession as economic and profit growth metrics continue to show robust trends, the year-over-year comparison into Calendar year 2019 will likely show slowing of profits. That said, two large investment firms recently came out with bullish predictions – Wells Fargo calling for +12% upside from last week’s close and Goldman Sachs’ prediction that the S&P 500 will recover to 2,850 by year end, representing another significant rebound of +7% from last week’s close. In contrast, Morgan Stanley countered these views with "We think this 'rolling bear market' has already begun with peak valuations in December and peak sentiment in January." It is our view that without any indication of an imminent recession - which typical trigger bear markets - then Goldman Sachs’ prediction is the most likely scenario (+7%); with a caveat that should valuations become stretched again, investors should execute tactical allocation changes and bank some profits. There were three "other" times where the S&P 500 was up +1% in 3 consecutive trading days (Oct '11, Feb '16 & June '16) and all marked a bottom to the market corrections - let's hope this technical data point holds. The forward 12-month P/E ratio for the S&P 500 is now down to 15.5. This P/E ratio is below the 5-year average (16.4) but above the 10-year average (14.5). Next week, all eyes will carefully watch the election results for potential leadership changes in Congress.