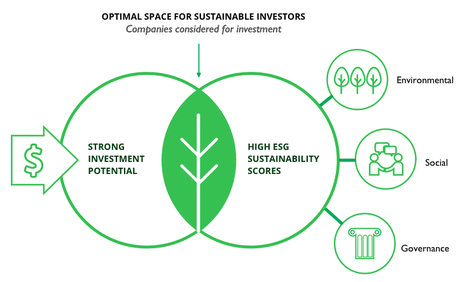

The terms “sustainability”, “environmental, social and governance" (ESG), or “social responsible investing” (SRI) have been used interchangeably in the past to categorize companies that take voluntary actions to manage its environmental and social investing impact to render a positive contribution to society. Insofar as there are nuance differences for these broad sustainable investing categories, there is also a good deal of common ground since socially conscious investors expect more from their investments than just financial return given their desire to incorporate social objectives.

As an advisory firm we have been focused on ways to put our clients' capital to work in a more sustainable way with an aim toward long-term value creation that enables clients to address their financial goals while also meeting their responsible investing needs. Indeed, through the lenses of sustainability we seek investment opportunities, manage dynamic factor exposures and ultimately deliver broadly diversified, economically representative portfolios. Our goal in constructing a socially conscious portfolio is to implement a defined strategy with asset-class diversification in place, risk management and good defensive planning.

Corporate policies are a key determinant of firm value and recent studies have found that “firms with good ratings on material sustainability issues significantly outperform firms with poor ratings on these issues.”* According to a 2018 Morningstar study, "65% of sustainable equity funds outperformed their peers, with more than twice as many finishing in their category’s top quartile than in the bottom quartile." Thus, these recent ESG studies “bolsters the idea that focusing on such investment themes can generating alpha, or outperformance over a benchmark, in addition to being a way for investors to express their moral views through their holdings.”

This is why more than one-in-five dollars invested by professionals - or about $8.7 trillion dollars - are invested in the United States with sustainable, responsible and impact investing. Yet, remarkably the majority of advisors disregard sustainable investing considerations altogether. For example, a Morgan Stanley study showed that 71 percent of individual investors are interested in sustainable investing, while more than 60 percent of advisors have little or no interest.

Sustainable and SRI investments have an aim for good investment performance together with portfolio holdings that should be used to contribute to advancing social, ethical, environmental, human rights and governance practices. We actively allocate assets on this knowledge with many investment options that deliver a positive social and environmental impact, such as community bonds, green bonds, ethical governance stocks, ESG mutual funds and/or low cost ETFs with holdings screened for social, human rights, and environmental criteria. The majority should be allocated to a broadly diversified portfolio with your long-term goals and risk tolerance.

As an advisory firm we have been focused on ways to put our clients' capital to work in a more sustainable way with an aim toward long-term value creation that enables clients to address their financial goals while also meeting their responsible investing needs. Indeed, through the lenses of sustainability we seek investment opportunities, manage dynamic factor exposures and ultimately deliver broadly diversified, economically representative portfolios. Our goal in constructing a socially conscious portfolio is to implement a defined strategy with asset-class diversification in place, risk management and good defensive planning.

Corporate policies are a key determinant of firm value and recent studies have found that “firms with good ratings on material sustainability issues significantly outperform firms with poor ratings on these issues.”* According to a 2018 Morningstar study, "65% of sustainable equity funds outperformed their peers, with more than twice as many finishing in their category’s top quartile than in the bottom quartile." Thus, these recent ESG studies “bolsters the idea that focusing on such investment themes can generating alpha, or outperformance over a benchmark, in addition to being a way for investors to express their moral views through their holdings.”

This is why more than one-in-five dollars invested by professionals - or about $8.7 trillion dollars - are invested in the United States with sustainable, responsible and impact investing. Yet, remarkably the majority of advisors disregard sustainable investing considerations altogether. For example, a Morgan Stanley study showed that 71 percent of individual investors are interested in sustainable investing, while more than 60 percent of advisors have little or no interest.

Sustainable and SRI investments have an aim for good investment performance together with portfolio holdings that should be used to contribute to advancing social, ethical, environmental, human rights and governance practices. We actively allocate assets on this knowledge with many investment options that deliver a positive social and environmental impact, such as community bonds, green bonds, ethical governance stocks, ESG mutual funds and/or low cost ETFs with holdings screened for social, human rights, and environmental criteria. The majority should be allocated to a broadly diversified portfolio with your long-term goals and risk tolerance.

Our clients are diverse in age, ethnicity, religious denominations and gender, which also can come with a host of unique goals that include specialized socially responsible investment mandates. We apply discipline of risk management in our investment strategies for SRI investing and this approach incorporates client goals while also delivering custom solutions. For example, we can even target specific goals like women’s rights, animal rights, ban on guns/weapons, racial diversity and/or gender diversity.

We believe that active management and impact investing should co-exist to meet a client's overall objective.

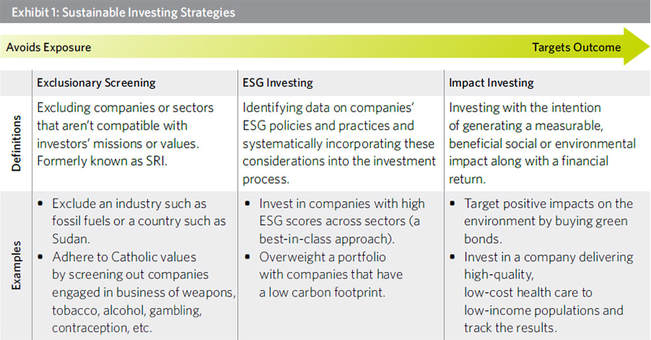

We apply a dual perspective in creating a positive investing impact through mission driven negative screening, together with positive screening. This unique collaborative approach is designed to effectuate a portfolio that delivers positive long-term financial returns while also screening out companies that do not align with investors values - by actively seeking investments to create positive social, environmental or impact results.

We believe that active management and impact investing should co-exist to meet a client's overall objective.

We apply a dual perspective in creating a positive investing impact through mission driven negative screening, together with positive screening. This unique collaborative approach is designed to effectuate a portfolio that delivers positive long-term financial returns while also screening out companies that do not align with investors values - by actively seeking investments to create positive social, environmental or impact results.

- Avoidance: Not investing in companies whose activities are contrary to our social and moral values. Many causes ,religious doctrines have “No Buy Lists” which we adhere to with the appropriate investment parameters for clients - certain stocks that are considered immoral (this process is known as screening on items such as corporate governance).

- Affirmative Investing: Investing in institutions that can provide financial resources to deliver value in many forms, or has ESG corporate policies: environment, underserved communities, animal rights, social issues, diversity, ethical & moral compass, etc.

- Advocacy: Voting proxies and activism that focus on constructively influencing corporate behavior.

Moreover, ESG investing can take many forms, even within one particular moral objective category. For example, there are diverse faith-based religious investment principles that may have unique nuances even for denominations within Christianity, such as mandate differences between Catholic, Lutheran, Presbyterian, Baptist, Protestant, Methodist or Episcopal. Similarly, Jewish-based religious doctrines also have diversity – such as Orthodox, Reform or Conservative – and these denomination branches can also have unique investment impact mandates.

We embrace the movement of investors seeking to direct their money into portfolio investments that contribute to the well-being of the planet and humanity for two reasons: 1) we believe investors should consider the greater good with their portfolio and help effectuate positive change and 2) we have strong conviction that investing can be consistent with both ones values and investment return/risk objectives. As advisors, we continue to study and advance our own SRI tools as the investment landscape for having a positive impact on the world continually shift toward greater breadth and lower costs. We are also sensitive to each client’s unique needs and try to accomplish governing investment goals within a framework of their individual socially responsible objective.

Please setup an initial complementary meeting with us where we can have an opportunity to convey how to charter the best course to achieve your unique investment path.

Click Here to Email & schedule a no obligation complimentary initial advisory meeting & portfolio review.

SERVING SANTA BARBARA COUNTY, VENTURA COUNTY & SAN LUIS OBISPO COUNTY

Montecito Capital Management

225 East Carrillo Street, Suite 203

Santa Barbara CA 93101

(805) 965-7955

SERVING LOS ANGELES COUNTY, SAN BERNARDINO COUNTY & ORANGE COUNTY

Montecito Capital Management

522 S. Sepulveda Boulevard, Office 207

Los Angeles, CA 90049

Email Us: [email protected]

* Khan, Mozaffar, Sarafeim, George and Yoon, Aaron S. “Corporate Sustainability: First Evidence on Materiality.” The Accounting Review, Volume 91, 2016

Investment Advisory Firm Offices serve San Luis Obispo County, Santa Barbara County, Ventura County, Los Angeles County & Orange County

Disclaimer: The website provides general information regarding our business along with access to additional investment related information. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. The intent is to provide helpful information, which should NOT be construed as investment advice. We do not guarantee its accuracy, nor completeness, and it is not intended to be the primary basis for investment decisions. We do not make personal investment recommendations to people or entities except to those who have engaged us expressly for the purpose of providing professional investment advisory services. Montecito Capital Management Group’s ADV filing is available online at http://www.adviserinfo.sec.gov and current FORM ADV Part 2, which describes the services offered, fees charged and detailed company information, among other things, is available upon request free of charge. We are limited in our fiduciary capacity by the firm's non-discretionary client relationship, whereby the client dictates the investment parameters and contractually agrees to accept sole responsibility for their choices.