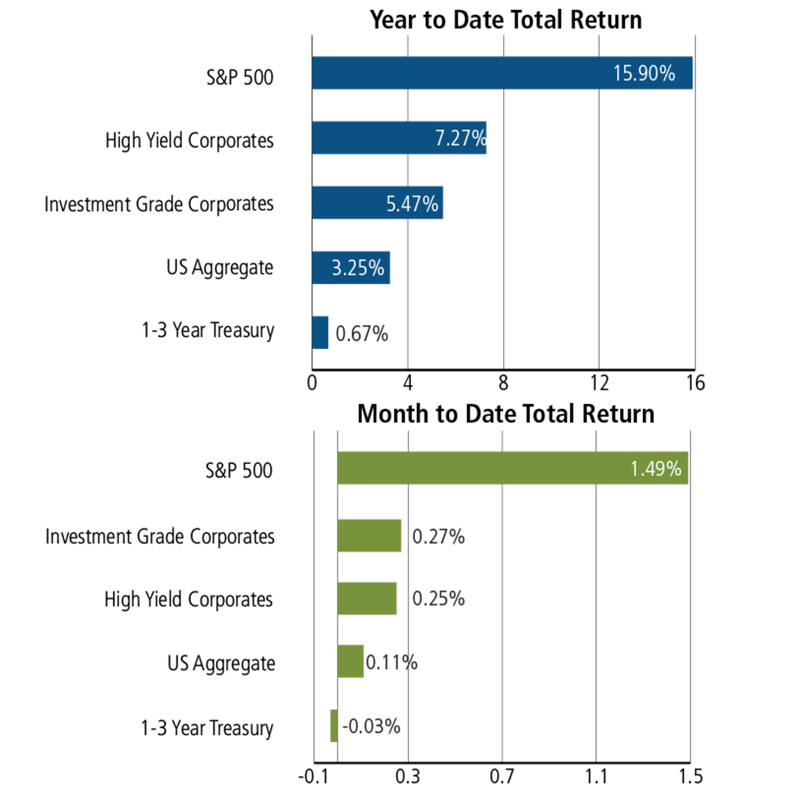

-October 20, 2017 Weekly Market Roundup. Equities continued to rally for the week on upbeat earnings and news that the Senate approved the tax relief bill as part of a 2018 budget resolution. The S&P 500 moved +0.88%, the Nasdaq eked out +0.35% and the Dow Jones jumped +2.04% for the week. For the roughly 20% of S&P 500 stocks that have reported third quarter earnings, 76% of the companies beat consensus earnings estimate. Moreover, 78% of S&P 500 companies have beaten sales estimates for Q3 to date with 10 of 11 sectors reporting revenue growth for Q3 - above the 5-year average of 55%.

-The relatively accommodative (dovish) monetary policy environment, improved global growth (in particular in the U.S.) & tepid inflation were strong contributing drivers for the capital markets so far for the year. However, the overhanging concern for potential volatility is sustainability of quality earnings growth and the fulfillment of tax reform expectation of lower corporate taxes. We believe earnings will still deliver for the third quarter (so far 81% of companies beating estimates), but a good number of companies will be impacted by one-time hurricane events. We also believe some form of tax reform will take hold, but not until the first quarter of 2018. At this stage in the market rally and with equity indices hitting new highs it is important to have a historical perspective. "Since 1928, there have been 29 times (prior to 2017) that the S&P 500 made a 12-month high in the month of September; in 24 of those cases, the market continued to rise during the fourth quarter. Overall, for all periods (including the five down quarters) following a September high, the market gained +3.7% on average). Moreover, when rising bond prices accompanied the new September high in stocks, the average S&P 500 fourth quarter gain was 5.4%.” (Source: Leuthold Group)

-October 13, 2017 Weekly Market Roundup. We're seeing a continuation of the strength in the market combined with low volatility as the S&P 500 returning +0.17%, the Nasdaq finishing +0.25% and the Dow Jones rising +0.43% for the week. Of the public companies that have reported 3Q17 earnings, 81% of the stocks reported better-than-expected results - most of these companies fall within the financial sector. Looking at the 3-month moving average, the U.S. economy is trending at the lowest number of unemployed people for each job opening on record, at 1.15. Finance ministers & central bankers from the International Monetary Fund and the World Bank had meetings this past week and the capital markets received no unsettling surprises from the gathering of top global economic officials.

Government Tax Reform, its tentative framework: Collapse tax brackets from seven to three, 12%, 25% and 35% (from 39.6%) and double the standard deduction to $12k for individuals and $24k for married couples and increase the child tax credit. Eliminate the complicated AMT and most itemized deductions with the exception of mortgage interest. Also, the far reaching changes includes the repeal of estate taxes, bringing a big windfall to the wealthy. However, for Californians, with high state & local taxes, the tax overhaul would eliminate state & local tax deductions - a big concern. The small business rate will move to 25% (vs. individual rates) while the corporate (stock) tax rate would drop to 20%, with immediate write-off of the cost of new investments for 5 years. Our view: Bodes well for stocks, but the plan is not as rosy for small businesses which count on itemized write-offs. Also, why lower tax bracket for big corporations vs. small businesses, the latter of which is the life blood of US economic growth? How is the repeal of estate taxes going to help 99% of Americans who are already covered by the preexisting $5.49 million estate tax exemption?