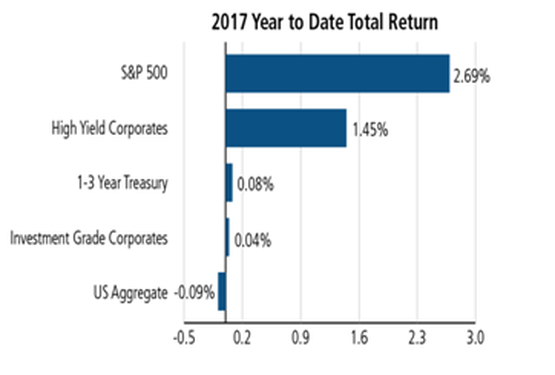

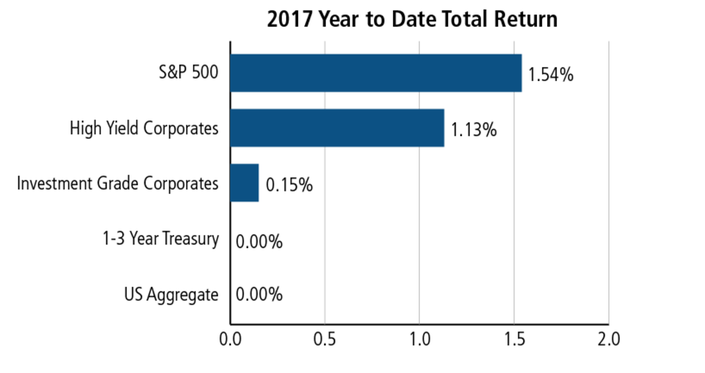

Total Returns by Asset Class (YTD Jan 20, 2017)

-January 13th, 2017 Weekly Market Roundup. Markets shifted between modest gains and losses this week to close roughly unchanged. The upcoming fourth quarter corporate earnings reports should provide indications of near-term market direction, and more importantly, insight from management teams’ outlooks for the year. For example, a few large financial firms have reported fourth quarter results with favorable revenue & profit trends, including very positive remarks on the business prospects moving forward. Ahead of the reporting season, analysts are projecting the companies within the S&P 500 index to have revenue increases of +4.6%, along with improved earnings (+3.2%). The World Bank said this week it expects the world economy to expand +2.7% this year, on the heels of stabilizing and slightly rising commodity prices and fiscal stimulus in the US.

-The Conference Board’s Consumer Confidence Index climbed to 113.7 (1985=100) - the highest level since August 2001. It moved +4.3 points higher than November’s level, while beating the prior forecast of 109 (according to Bloomberg reports). Further, the Markets: Proportion of consumers expecting higher share prices in 2017 increased to 44.7% in December, the largest since January 2004.

-January 6th, 2017 Weekly Market Roundup. Equity markets welcomed the New Year with gains in all sectors as all major indices advanced. While the Dow fell just short of reaching 20,000, the S&P 500 closed at an all-time high on Friday. Driving much the rally has been the incoming Trump administration’s priorities including tax, health care, and regulatory reform as well as infrastructure spending. Also, helping equities march higher was the December jobs report, which showed that the economy added 156,000 jobs in December and average hourly earnings grew 2.9% over the past year.

Montecito Capital Management Group's 2017 Market Outlook & Forecast:

As we enter 2017 we expect the current economic rebound to continue suggesting GDP growth will likely move toward the 2.7%-3.0% level by the end of the year based on less monetary stimulus, more fiscal stimulus, a reduction in the corporate tax rate and deregulation.

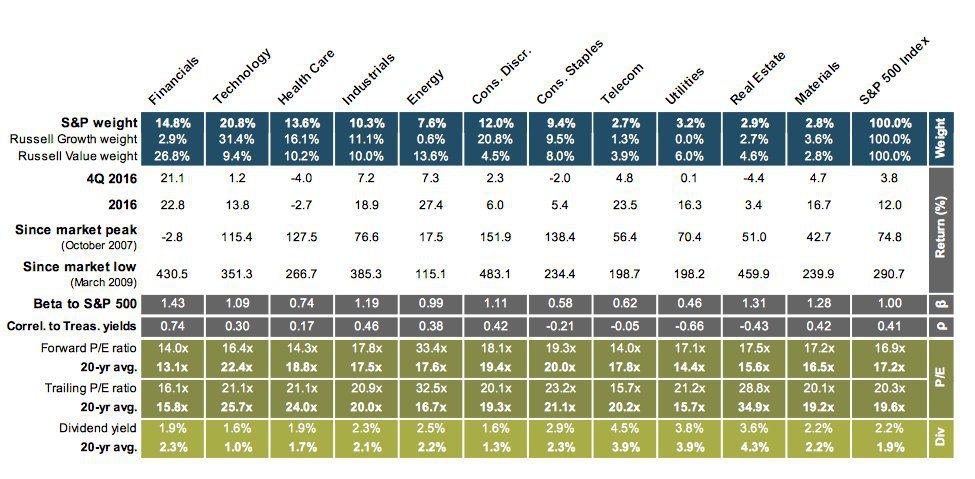

The S&P 500 equity index is currently trading at about a forward 2017 price-earnings ratio of 17x which is a rich value, but not as lofty as the 2000-2001 tech bubble (nor as cheap as 2009). Wall Street currently forecasts a +5.5% gain for the S&P 500 in 2017 (average of 15 firms) and sees the index reaching 2,363 by year end, from its 12/31/16 close of 2,239. We believe the market has the potential for +7.5% in 2017 given more indirect investment currents where lackluster bond downward pricing will likely engender an extended redistribution from bonds to equities. We also believe the S&P 500 returns will be front loaded, where the largest percentage of gains will be in the first half of 2017.

The incoming administration has promised a much more business-friendly atmosphere including lower taxes and less regulation. Trump has control over both houses of Congress. Also, in the years when that has occurred, equiteies have returned an average of +14% per annum. Having Congressional & Executive Branch control is historically rare for a Republican administration. Trump wants to cut the corporate tax rate, and congress is in agreement, making it likely to happen. According to Citi, if the rate was cut to 20%, it would add $12 to their top-down estimate of $130 for 2017 S&P 500 earnings per share (or about +10%,).

2016 Returns By Sector, Shows Clear Sector Winners, Losers & Benchwarmers: