-Market 21, 2018 Market Update. The Federal Reserve moved rates +0.25% today to 1.75%, which was in line with expectations. Powell, the Fed Chair, also appeared less hawkish with an indication that the expected three rate increase for the year remains unchanged; though it was indicated that the Fed would remain open to sharper increases should the economy overheat. The Fed also increased the GDP growth rate for the year to 2.7% from 2.4%. The S&P 500 and Dow industrials both slid -0.18%, while the Nasdaq fell 0.26% for the day. The average 30-year fixed-rate is now about 4.5%, up from 4.15% on Jan. 1st and significantly higher than the record low of 3.5% back in December of 2012.

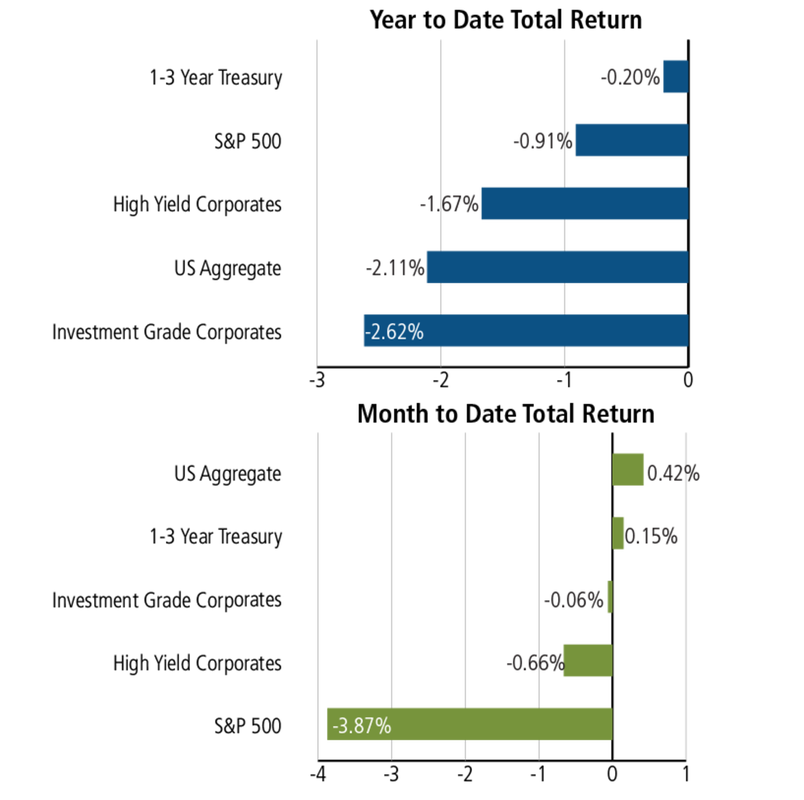

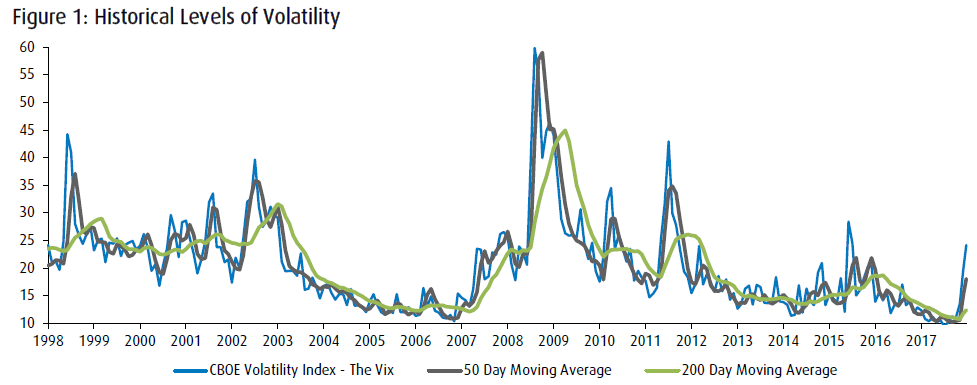

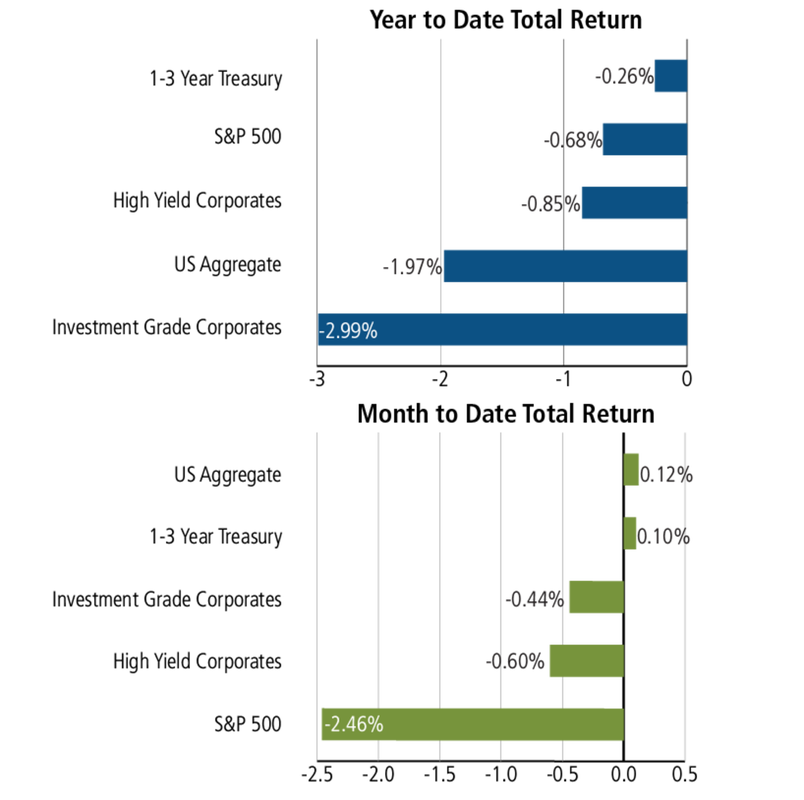

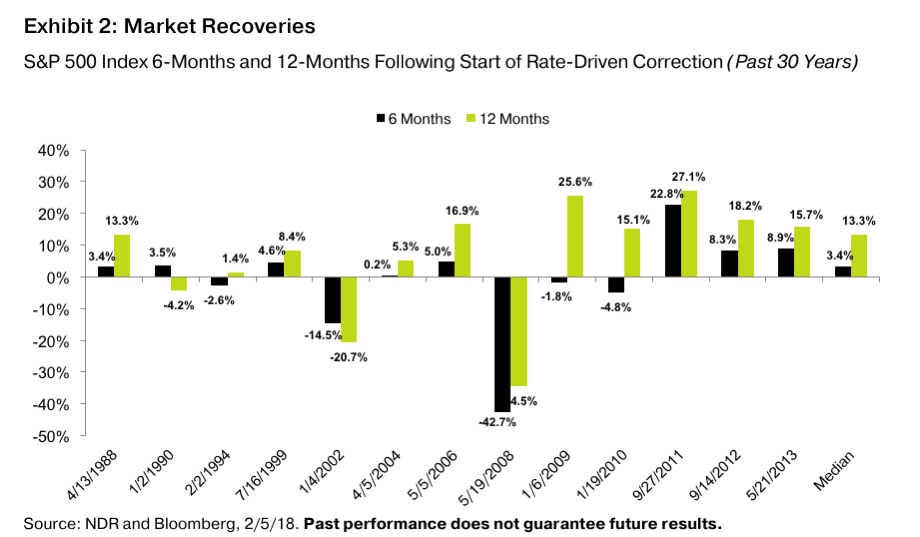

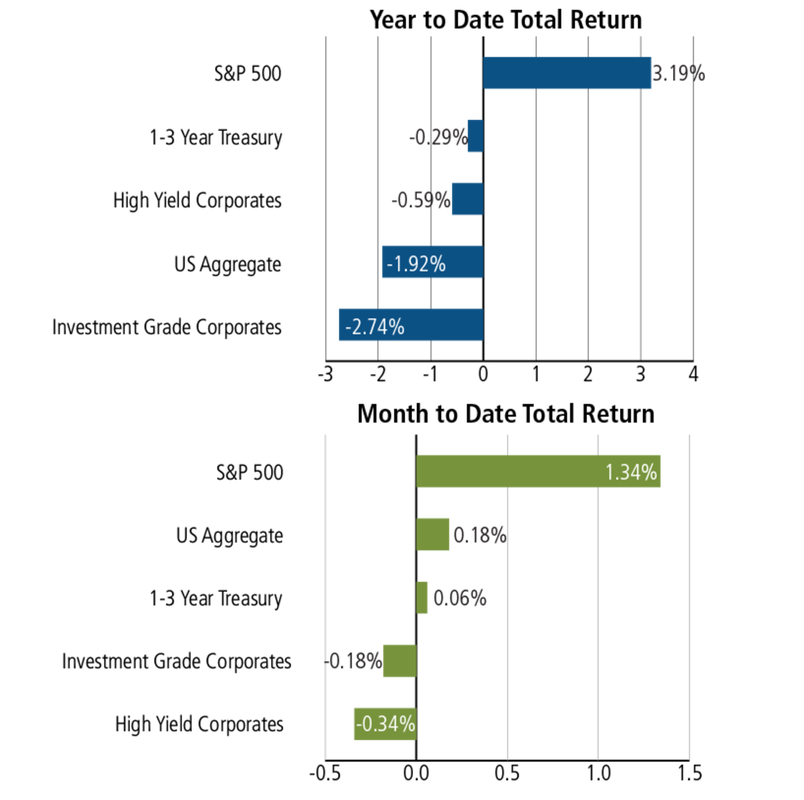

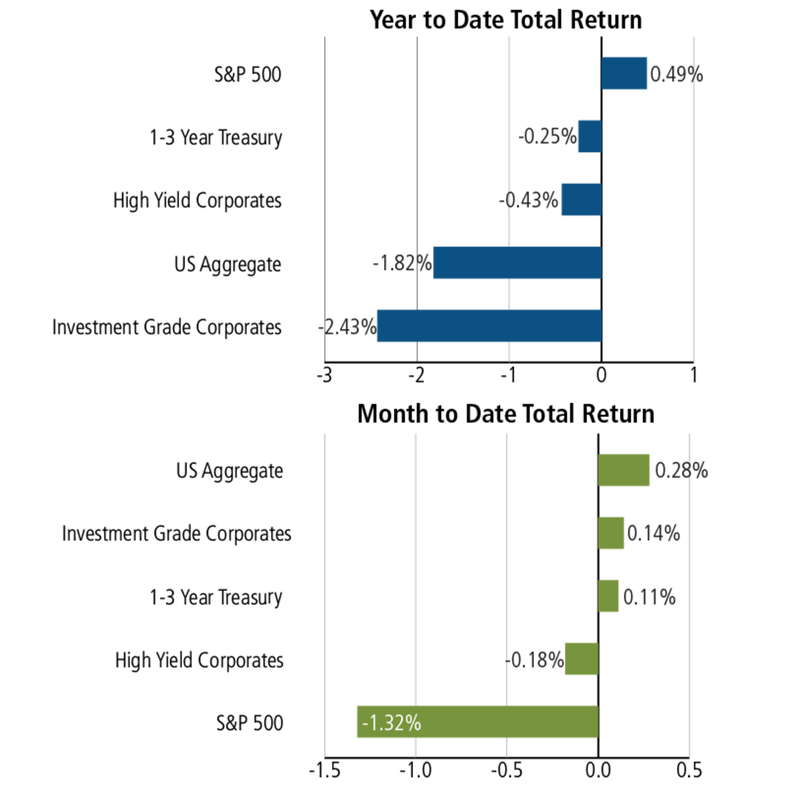

-March 19, 2018 Market Update. Over the past five (5) trading days, the S&P 500 has given back -2.48% and the Nasdaq -3.22%. During periods of volatility it is a great time to reevaluate investor risk aptitude and potentially reallocate investment holdings. However, it is also paramount that investors keep their long-term investment objectives in place and not make emotional decisions. As investment advisors we consider short-term price volatility as an opportunity and high price valuations as risk. We also emphasize that the understanding of risks embedded in a portfolio is central to providing value to our clients. We subscribe to managing dynamic factor exposures while still delivering broadly diversified, economically representative portfolios. We think of investing in terms of probabilities instead of binary outcomes and therefore we apply a selective multi-asset return approach of diversity for risk management. We also continue to educate our clients on investing and think it is important to share valuable historical perspectives on periods characterized by market stress and volatility. For example, from the beginning of the equity market correction decline, of which the -10% was reached back on February 8th of this year, the median return of the S&P 500 Index has been +3.4% after a period of six-months. However, the more telling fact is that 12 months from the beginning of the equity market correction decline the median return of the S&P 500 Index has been +13.3%. Also, these corrections were driven by changes in rates, causing overall market jitters over interest rates. (Refer to Exhibit 2, below)

-This fact about female executives speaks for itself: "Over the past seven years, S&P 500 companies where at least 25% of executives were female generated higher one-year returns on equity than the overall index, on a median basis, according to data compiled by the BofA." Moreover, according to McKinsey study: "Companies in the top quartile for gender diversity were 15% more likely to see their operating income surpass the industry median."

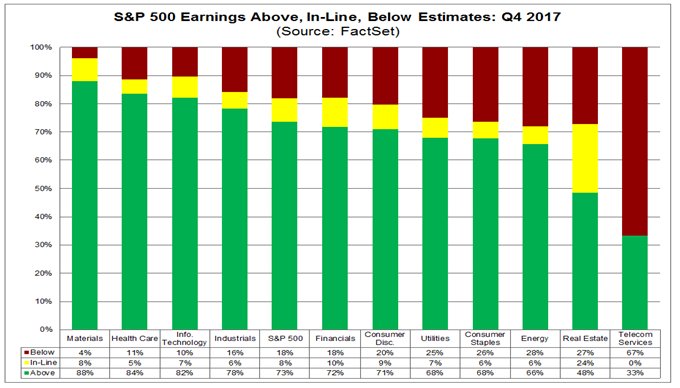

-March 9, 2018 Weekly Market Update. The equity markets traded down most of the week on fears of a trade war, but quickly rebounded on news that steel and aluminum tariffs would exclude imports from Canada and Mexico. The stock market's late week recovery was also aided by strong economic data punctuated by an outstanding employment report, with a whopping 313,000 new jobs reported in February. For the week, the S&P 500 returned +3.59%, the Dow Jones gained +3.34% and the Nasdaq surged +4.17%. On the earnings front, 73% of the S&P 500 ($SPX) companies beat EPS estimates for Q4, a figure that is well above the 5-year average of 69%. Since the US trade deficit continues to expand, it is our view that this provides a good pulse on the health of our U.S. economy where robust domestic demand continues to drive import activity. It’s when the trade deficit shrinks, well, that is when investors should look deeper in the trade numbers to determine if it is slowing demand or currency exchange headwinds.

-March 3, 2018 Trump Tariff Viewpoint: Going back to 1776 Adam Smith, tariffs have had a disruption effect that hurts the many at the benefit of the few (steel industry). George Bush tried some steel tariffs briefly and while it effectuated a brief industry boost, it still didn’t work out for the steel workers in the long-run. It is not about why can others get away with it. The U.S. is the largest economy in the world and therefore there will be far more significant negative ramifications. The bigger issue is other countries will retaliate with tariffs and this will create both pricing and industry disruption when for the first time in over a decade the entire world is finally growing GDP in tandem (general economic health worldwide). Even China has been moving in the right direction - in 2015 China reduced many import tax rates for clothing, footwear, skincare products, diapers and other consumer goods to boost domestic consumption. The average reduction is more than 50 percent. The odds are that many products will be going higher for our US consumers (steel based-products like autos-airplanes-bikes, blue jeans, even beer!) and Europe has already responded with a proposed tariff against Harley Davidson, Electrolux not making the $250M cooking factory in Tennessee, etc. None of this is good and clearly is at odds with prevailing economic theory, including painful historical lessons going back to the Great Depression (Smoot-Hawley Tariff). Tariffs derail free market competition and this competition enables the consumer to reap the lowest price. Now the price of the good with the tariff has increased, the consumer is forced to either buy less of this good or less of some other good. The price increase can be considered a reduction in consumer income. Since consumers are purchasing less, domestic producers in other industries are selling less, engendering a decline in the economy (if trade ware escalates to other industries). Incidentally, our firm is on record as early as Nov 9, 2016, in a Wealth Management Magazine article where firm founder, Kipley Lytel CFA expressed concern over the potential for Trump protectionist policies engendering a trade war:

http://www.wealthmanagement.com/industry/many-advisors-smile-trump-s-victory

-March 2, 2018 Weekly Market Roundup. Volatility returned to the equity markets this week as stocks sold off on announced tariffs on steel (25%) and aluminum imports (10%), raising fears of a trade war. All U.S. equity market indices reported losses for the first week of March with the S&P 500 -1.98%, Dow Jones -2.97% and Nasdaq -1.12%. Meanwhile, the (CBOE VIX) jumped 19% to 19.59; despite the spike in VIX, volatility remains down more than 50% from its intraday peak last month. The capital markets are also still processing the upbeat Fed Chair (Powell) outlook that indicated a possible fourth rate hike this year, up from the three originally planned. It is our view that volatility typically continues for a short period after a market correction (-10%) and history tells us that this is not an uncommon occurrence in long-running bull markets. In fact, a recent Guggenheim study revealed “The majority of declines fall within the 5-10 percent range with an average recovery time of approximately one month, while declines between 10-20 percent have an average recovery period of approximately three months.”