-June 25, 2018. We are pleased to announce that this year has brought yet another accolade of recognition with the Wealth & Money Management Award for Best Wealth Management Practice 2018 in Southern California. The official announcement of this recent award included the following: "The 2018 Wealth & Money Management Awards continues to be dedicated to celebrating the hard work, and dedication, of those working in this integral industry from asset managers, financial planners, HNWI services and specialist banking providers to name but a few. Financial management is an arduous and complicated task; therefore, many individuals, business people and families look for support to guide them through the complex process of managing their money. From ensuring tax compliance, to assisting clients through monumental life changes, those working in the wealth management industry often become much more than just advisors, developing strong relationships with clients as they navigate many of life’s challenges together."

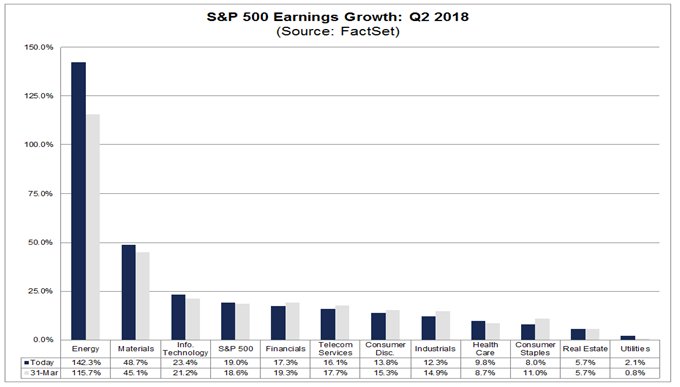

-June 22, 2018 Weekly Capital Market Update. The broad US equity market indexes declined on the week amidst ongoing concerns of a global trade war with S&P 500 -0.87%, the Dow Jones -2.03% and the Nasdaq -0.69%. This week’s Trump policy threats were directed at almost $450 billion tariffs on US imports from China (equates to value of total imports in 2017) and 20% levy on EU auto imports. In turn, both regions responded with retaliatory counter-tariff intentions, while China also indicated more hawkish regulations on local operating US companies. With all the smoke of trade wars brewing (no fire yet) it is no wonder why the positive fundamentals in the US economy are being discarded by the capital markets. For example, S&P 500 $SPX is projected to report earnings growth of 19.0% in Q2 2018, which would be the 2nd highest earnings growth since Q1 2011 (graph below). We have written extensively about the economic drag on the global economy (see March 3 Tariff Viewpoint: http://www.mcapitalmgt.com/blog/archives/03-2018). These miscued US policies would have severe ramification on future corporate earnings. Case in point, Materials and Industrials stocks, which could be significantly affected by a global trade war, sharply underperformed on the week. Nonetheless, a “trade war” tipping the global economy into a recession still remains a low probability given world trade has almost tripled since 1996 & the trade war escalation still remains in the threat phase (perhaps simply a negotiation tool by Trump).

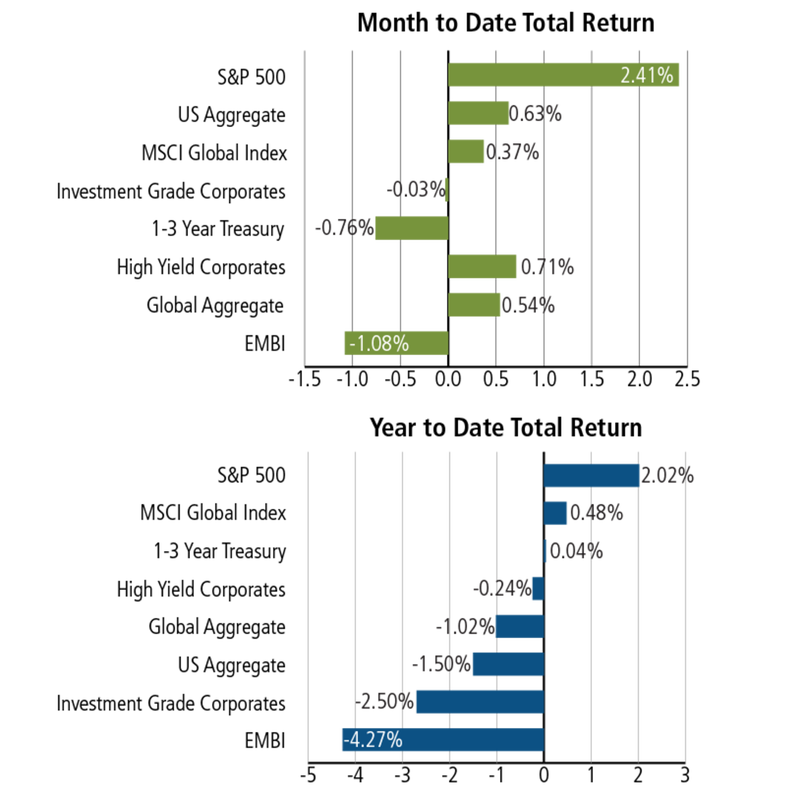

-June 8, 2018 Weekly Capital Market Update. With improved investor sentiment all major U.S. Equity Indexes rallied on the week: S&P 500 +2.76%, the Dow Jones +3.74% and the Nasdaq +2.73%. Indeed, every sector posted gains with the exception of the staid yield play of Utilities. While domestic stock strength has returned, emerging markets continue to be walloped (-4.34% week, -13.38% YTD) due to U.S. interest rates, the rising dollar and continued trade tension. The U.S. Corporate Bond Index also has a negative total return of -3.1% for the year, with the long bond’s total return being a woeful -5.4%. This bond rout is largely related to the expectation of several more rate hikes by the Federal Reserve which theoretically would reward investors to wait to invest in higher yielding securities down the road.

June 1, 2018. Monthly Stock Market Returns & Recap for the Month of May 2018: Though it was a wild ride, all major markets finished positive on the month with the S&P 500 +2.41%, Dow Jones +1.41% and Nasdaq +5.61%. There were several positive underpinnings behind the month's uptick in equities, including: 1) upwardly revised GDP growth to 3%, 2) unemployment dropping to 3.9%, 3) business outlook survey suggesting a pickup in manufacturing sector growth (ISA moved to 58.7), and 4) higher construction spending. Furthermore, corporate capital spending (capex) has increased almost +9% since the presidential election (Q4/16) as a result of pro-business policies and the need to expand capacity. Finally, some of the popular, highly-valued tech leaders recovered during the month which, in turn, boosted the S&P 500 and Nasdaq. Morgan Stanley put out a statement this week calling George Soros’ warning of a financial crisis “ridiculous”. Morgan Stanley CEO James Gorman said while some of Soros’ concerns are warranted, others are not. For instance, Gorman said about Soros’ view of the EU that “I don’t think we are facing an existential threat at all”.