-July 6, 2018 Weekly Capital Market Update. The S&P 500 gained +0.78%, the Dow Jones returned +0.62% and the Nasdaq finished up +1.10% on the week. This week’s S&P 500 gains represent almost one-third of its total return for the year, while the Dow continues to underperform; the Dow remains in negative territory for the year as companies in this industrial index are expected to disproportionally shoulder more of the fallout from tariffs. Given this escalating global tariff environment we continue to favor technology services and small caps stocks, of which both have relatively low exposure to trade friction. For example, trade continues to dominate the headlines as the U.S. imposed tariffs on $34 billion in Chinese exports; China immediately reciprocated on an equal value of American goods, principally agricultural staples and vehicles. Given the current investment climate, we also remain comfortable with a number of our alternative strategy mutual funds, such as YCG Enhanced (YCGEX, +6.0%) and Janus Henderson US Managed Volatility (JRSTX, +7.4%) - both of which have enhanced returns related to volatility. Next week we have earnings season kicking off with some financial names (WFC, JPM & C), which are expected to have positive releases. Friday’s jobs report showed a larger-than-expected gain of +213,000 jobs in June with unemployment rising from 3.8% to 4%; the workforce grew by +601,000 jobs. However, economic fundamentals continue to be overshadowed by trade war rattling.

|

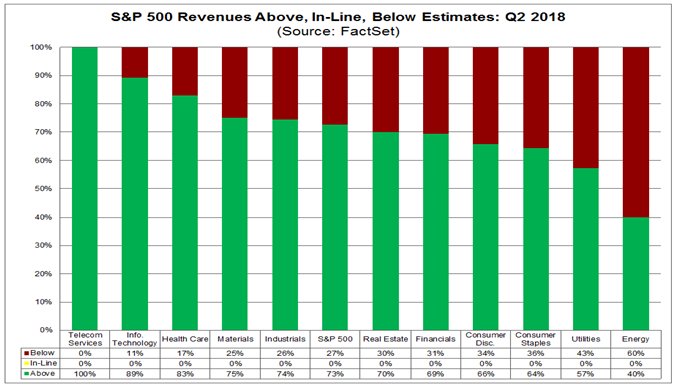

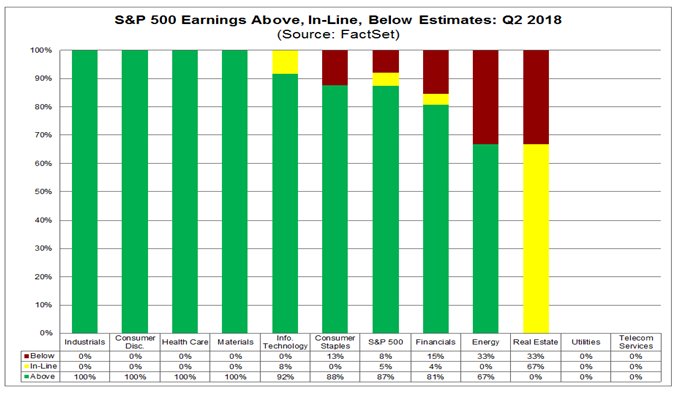

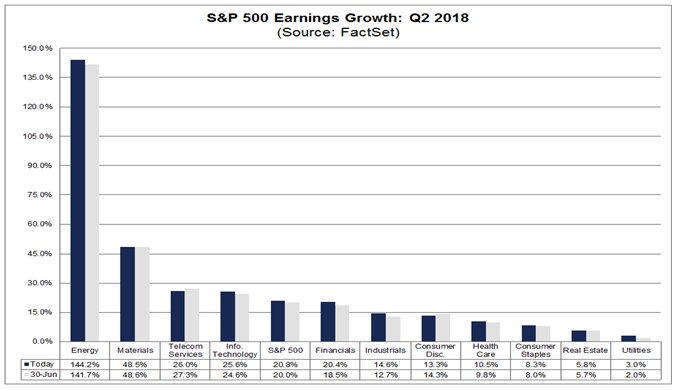

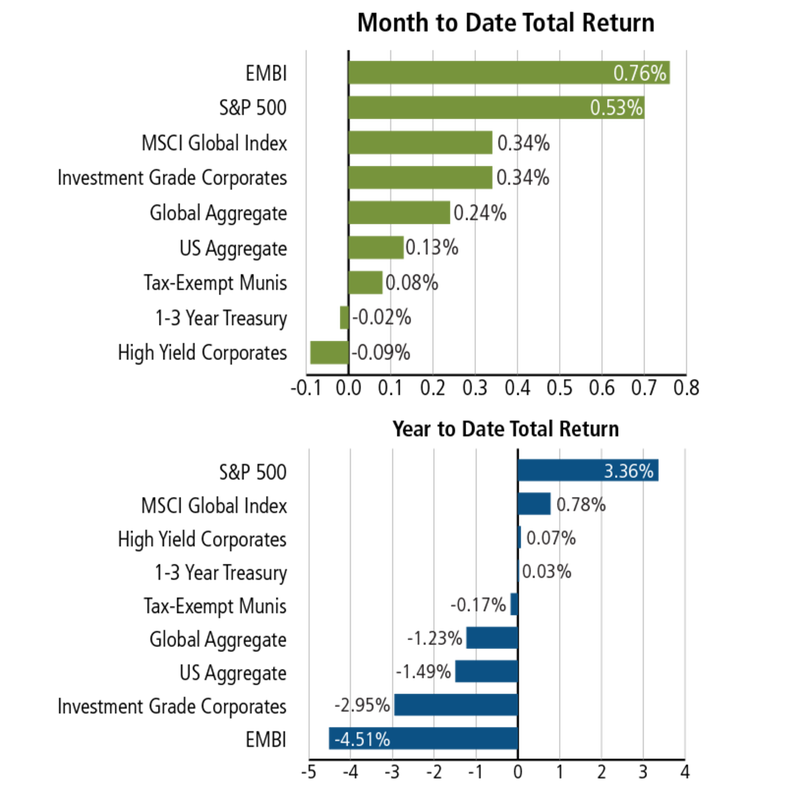

-July 27, 2018 Weekly Capital Market Update. The major equity indices were mixed for the week with the S&P 500 Index gaining +0.61%, the Nasdaq up +1.06% and the Dow Jones finishing down -1.67%. With 53% of the S&P 500 companies having reported results, we are deep into the second quarter (Q2) earnings season and 73% of $SPX companies have beaten sales estimates to date for Q2 - well above the 5-year average (58%). Also, high expectations by demanding investors were reinforced for technology stocks when their intolerance for shortfalls in earnings and revenue growth caused turmoil for Facebook (losing -20% in one day); FB reported slower growth and narrower profit margins. On the trade front, the European Commission and U.S. agreed to put proposed tariffs on hold in favor of trade negotiations. Also, China and the U.S. remain at an impasse on trade. In vignette, this week showed strong GDP growth (+4.1%), sharp earnings growth (+21.3%) and preliminary steps towards easing trade conflicts which together reassured the markets. However, uncertainties related to geopolitics and the mixed results from the technology sector kept many investors sidelined. -July 20, 2018 Weekly Capital Market Update. All the major U.S. equity market indices edged slightly upward for the week with the S&P 500 +0.02%, Nasdaq +0.15% and the Dow Jones +0.20%. Moreover, the overall S&P 500 Volatility Index (VIX) continues to smooth with volatility range trading in a tight, lower range of 11.9-13.3. According to FactSet, 77% of S&P 500 ($SPX) companies have beaten sales estimates to date for Q2, above the 5-year average (58%). Furthermore, $SPX is reporting earnings growth of 20.8% in Q2 2018, which would be the second highest earnings growth since Q3 2010. Revenue growth has been 9.0% in Q2 2018; highest revenue growth since Q3 2011. Unfortunately, trade friction continues to overshadow positive economic fundamentals with dominating headlines that perpetuate market pressures. For example, on Friday, President Trump announced his willingness to place tariffs on all $505 billion in Chinese goods imported to the U.S. -July 13, 2018 Weekly Capital Market Update. The major U.S. equity markets followed up with another round of weekly gains: S&P 500 +1.55%, Dow Jones +2.32% and the Nasdaq +1.79%. Even in the throw of escalating global “quid pro quo” trade tariff actions, investors remain skeptical of an all-out trade war. Indeed, while the U.S. announced an additional $200 billion worth of tariffs on Chinese goods in late August, both the U.S. and China signaled that they were open to resuming trade negotiations. For instance, China is increasingly unlikely to retaliate with additional tariffs since the goods imported from the U.S. for additional tariffs is becoming more finite, thereby mitigating these tariff options for China. That said, China could weaponize its $1.2 trillion in U.S. treasuries as another form of negation. A few banks released 2nd quarter earnings and JP Morgan’s Chairman James Dimon indicated that the U.S. economy is charging ahead on most fronts, and the tariff disputes are “affecting psyches more than economics.”

-July 6, 2018 Weekly Capital Market Update. The S&P 500 gained +0.78%, the Dow Jones returned +0.62% and the Nasdaq finished up +1.10% on the week. This week’s S&P 500 gains represent almost one-third of its total return for the year, while the Dow continues to underperform; the Dow remains in negative territory for the year as companies in this industrial index are expected to disproportionally shoulder more of the fallout from tariffs. Given this escalating global tariff environment we continue to favor technology services and small caps stocks, of which both have relatively low exposure to trade friction. For example, trade continues to dominate the headlines as the U.S. imposed tariffs on $34 billion in Chinese exports; China immediately reciprocated on an equal value of American goods, principally agricultural staples and vehicles. Given the current investment climate, we also remain comfortable with a number of our alternative strategy mutual funds, such as YCG Enhanced (YCGEX, +6.0%) and Janus Henderson US Managed Volatility (JRSTX, +7.4%) - both of which have enhanced returns related to volatility. Next week we have earnings season kicking off with some financial names (WFC, JPM & C), which are expected to have positive releases. Friday’s jobs report showed a larger-than-expected gain of +213,000 jobs in June with unemployment rising from 3.8% to 4%; the workforce grew by +601,000 jobs. However, economic fundamentals continue to be overshadowed by trade war rattling. |

Follow us on Twitter: @MontecitoCapMgt

July 2024

Categories |