-May 26, 2017 Weekly Market Roundup. Equity markets rebounded with the S&P 500 rising +1.47% and the Nasdaq returning +2.08%. The first quarter GDP growth estimate increased to 1.2%, from the initial 0.7% on improved consumer spending & business equipment purchases. Moreover, the preliminary reading for the Purchasing Manager’s Index of manufacturing and services activity rose from 52.7 in April to a better-than-expected 53.9 in May (anything above 50 indicate expansion).

-May 19, 2017 Weekly Market Roundup. The equity markets were shaken mid-week by President Trump’s political stumbles and the recent appointment of an independent special prosecutor to investigate the alleged Russia connection. However, the markets continued to show resilience on Thursday and Friday with positive gains. In the end, for the week the S&P 500 & Dow 30 both returned -0.32%, while the Nasdaq lost -0.61%. Much the recovery from early market losses were driven by positive economic indicators, such as low jobless claims and industrial production. During this period market volatility – which has been abnormally low for many months – spiked upward by over 30% ending the week at still heightened levels for the week at 12.04.

-The apparent never-ending miscues and political follies by POTUS and the WH finally shook Wall Street today, Wednesday 17th. However, there was no fundamental basis to justify the equity sell-off other than Trump’s credibility to pursue his agenda being further eroded. For example, corporate earnings, prospective GDP growth, employment and consumer sentiment all remain relatively supportive. Nonetheless, the markets drowned in red today and wiped out the entire month’s gains. The leading index returns for the day were as follows: S&P 500 -1.83%, Dow 30 -1.78% and Nasdaq -2.57%.

-Equity market volatility as measured by VIX is also commonly referred to by Wall Street as the “Fear Gauge". Last week the VIX market volatility gauge hit a 23-year low of 11.18. There is apparently little evidence that periods of low volatility have any correlation with future poor returns. In fact, a low VIX is just like high stock multiples—all they show is that investors have an optimistic view of the future.

-May 13, 2017 Weekly Market Roundup. Stocks marked the longest weekly losing streak in four months amid unimpressive financial results from large retailers and the continued White House controversy, which added another distraction to potential tax reform initiatives. Earnings season for the S&P 500 companies are largely over with more than 90% of companies in the S&P 500® Index showed an average 14.4% increase in earnings and an 8.7% increase in sales. Turning internationally, in Germany there was positive preliminary expansive GDP data for 1Q of +1.7% year-over-year, along with improved EU stability with France’s Emmanuel Macron Presidency.

-May 5, 2017 Weekly Market Roundup. For the week, the S&P 500 added +0.6% buoyed by solid jobs reports, strong corporate earnings and waning geopolitical concerns. Corporate stock earnings continue to show growing strength in the economy. With 83% of the stocks in the S&P 500® Index having reported results, the overall earnings growth rate has increased to 13.5%, up from 12.5% last week and 9.0% at the beginning of the reporting period. Employment and inflation data should support further Federal Reserve rate increases this year; the next hike may occur as early as June. Meanwhile, continued pressure on oil prices weighed on the energy sector with the influx of production from Libya, threatening to add to already high inventory levels of global crude.

-May 4, 2017 Market Update. The US equity markets remains range bound and it is now just over two months since the SPX nudged its head just above the 2,400 level. Technology has been the clear sector winner this year, up +16.3% followed by Healthcare which has rallied on hopes of Obamacare repeal. Conversely, the energy sector is down -10.3% this year, while consumer services and real estate have been narrowly trading in the +1% range.

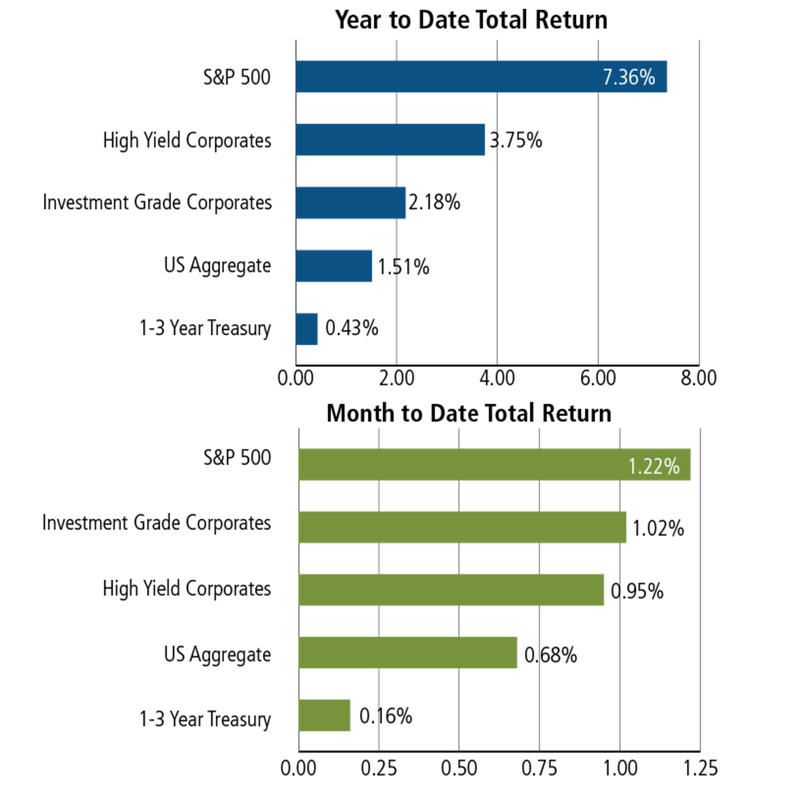

Year-to-date & April month-end index category returns: