March 22, 2024, Weekly Stock Market Return Recap, by Kip Lytel CFA. Wall Street optimism on stocks is at its highest level since early 2022, moving all US major indexes over +2% on the week. The S&P 500 gained 2.3% while the Dow climbed 2% marking its biggest weekly percentage advance since mid-December; the Nasdaq rose 2.9%, its biggest weekly percentage rise since mid-January. The Federal Reserve expects three quarter-point rate cuts this year, despite the recent uptick in inflation and the surging stock market. Fed policymakers did trim their expectation for rate cuts in 2025. Still, the Fed's key rate would fall to a range of 3.75% to 4% by the end of 2025. The economy remains elevated by an overall unemployment rate (U-3) at 3.7% with average hourly earnings rising to a nearly 2-year high in January 2024. Indeed, strong data points countered prominent economist forecasts of a looming recession.

March 15, 2024, Weekly Stock Market Return Recap, by Kip Lytel CFA. Stocks finished lower, notching a second consecutive losing week for Wall Street. The Nasdaq dropped 0.7% while the S&P 500 slipped 0.13% and Dow inched lower by 0.02% on the week. Investor enthusiasm ebbed, weighing down on the stock market with hot inflation worries. This week's Consumer Price Index (CPI) report portrayed some price pressures with February's core CPI popping 0.4%, marking a second monthly PPI jump. For those who called January’s hot CPI "a fluke,” the six-month annualized rate of change has been accelerating since last fall. The Labor Department said Thursday that its producer price index (PPI) rose 0.6% from January to February, up from a 0.3% rise the previous month. Measured year over year, producer prices rose by 1.6% in February, the most since last September. These inflationary figures are expected to present a challenge for the Fed’s policy toward easing when it meets next week.

March 8, 2024, Weekly Stock Market Return Recap, by Kip Lytel CFA. All major US equity market indexes finished down on the week: The Nasdaq Composite tumbled 1.2% to finish the week, the S&P 500 lost 0.3% and the Dow Jones Industrial Average ended the week 0.9% lower. Of the 500 companies in the S&P 500, 74 companies have issued negative EPS guidance for Q1 2024, which is above the 5-year average of 58 and above the 10-year average of 62.

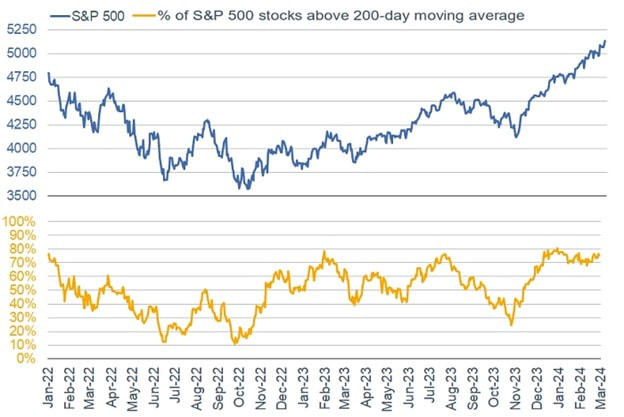

As shown below, 2024 has been marked by the S&P 500 reaching an all-time high (top chart), yet the percentage of stocks trading above their 200-day moving averages has been flat (bottom chart).