-February 6, 2018. The US equity markets are seeking an equilibrium between buyers and sellers, which has caused the S&P 500 to whipsaw all morning. Markets opened in the red with the S&P 500 falling -2.1% before bouncing back in the green where the equity index was up over 26 points, or about +1%. Then, the broad equity market index preceded to decline toward -1% and has since stabilized at break-even. Conversely, the Nasdaq has been holding relatively strong today. At this juncture, we don't know where the day's S&P 500 market close will end - however, we likely will see the continuation of equity market see-sawing. Volatility surged 106% yesterday and is currently trading at a sharply higher range of mid-40s; the long-term average VIX range should be somewhere between 15-20.

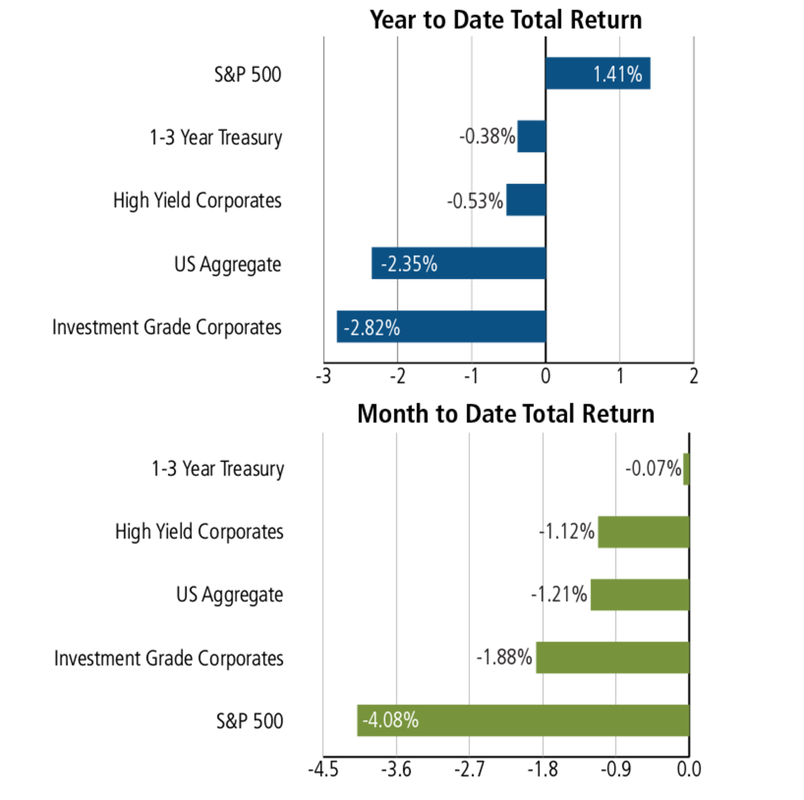

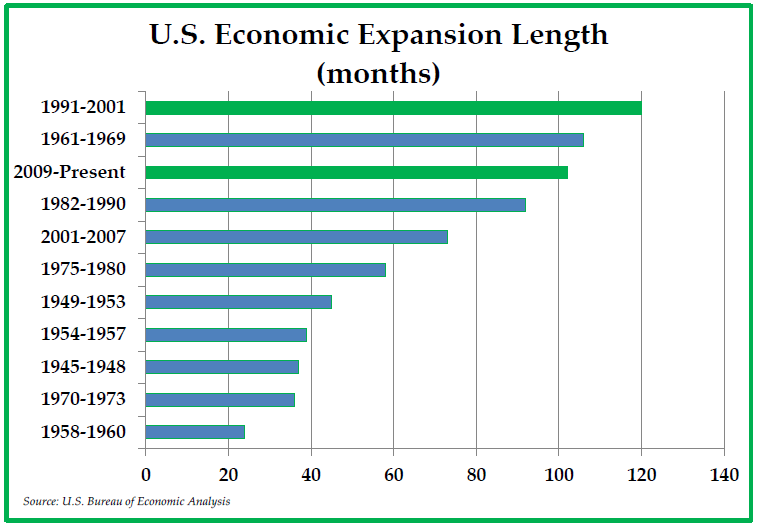

-February 5, 2018. What’s Going on with the Capital Markets? The sell-off in the U.S. stock market that began last week worsened on Monday, as the major indexes wiped out their year-to-date gains. Since hitting a record high on Jan. 26, the S&P 500 Index has fallen 8.5%. Meanwhile, the Dow Jones Industrial Average tumbled more than 1,100 points Monday, its steepest decline since 2011. At this juncture, it is important to remind our clients that we employ diverse multi-asset strategies to help mitigate the risk of material losses. Case in point is that with the S&P 500 down -4% today, our firm’s client portfolio losses have been far more muted with loss correlations being largely 40%-60% (depending on each client’s unique risk tolerance and return goals). To be specific, our client portfolio loss exposure range was 1.6%-to-2.4% at the market close. What we are seeing with this uptick of volatility is typical late-cycle behavior, though more exaggerated because investment assets are more sensitive to interest rate changes during late stage-cycles; also a precursor to the VIX spike was a sharp rise in bond yields. For example, there appear rising signs of inflation and this has spurred expectations that the Federal Reserve may hike interest rates more than anticipated in 2018. Yet, from a fundamental economic standpoint, high employment and strong pricing power isn’t such a bad problem to have. Stocks have been rising pretty much in a straight line since November 2016, and that's not exactly healthy. These are not big declines but rather overdue corrections. Indeed, with the exception of last year’s tiny -2.6% pullback, the S&P 500 hasn’t made it through a year in the past 20 without a temporary drop of at least -5.6%. The point is bull markets usually experience 2-3 pullbacks of -5% a year, along with a -10% correction every year-and-half or so. The larger point is that a market consolidation of a -10% correction is about six-months overdue and has the potential to run a bit deeper than where the S&P 500 trades now. That said, the mood remains overall positive globally on earnings growth and GDP, while tax benefits are expected to elevate corporate profits on the domestic-side in the first-half of 2018. There is also a fair amount of cash on the side, which is in place for opportunistic investments. Final thought is should markets exhibit a secular (long-term) trend of risk-off, we would implement portfolio strategies to mitigate exposure to any severe collapse in equity market values. To be clear, we do not think we are in a bear market but want to remind our clients that we are not complacent advisors that just ‘buy and hold.’

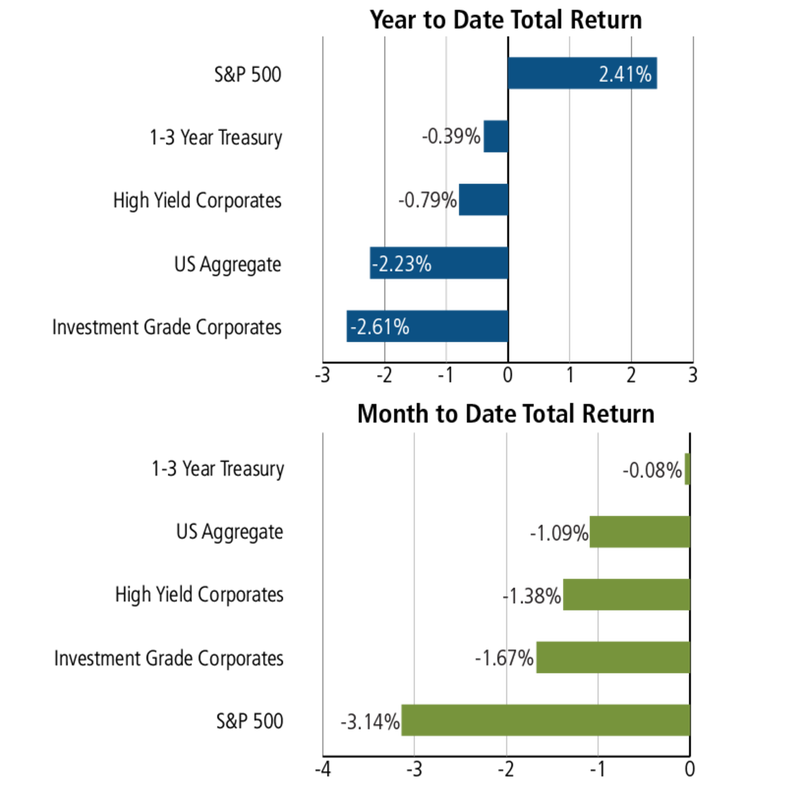

-February 3, 2018 Weekly Market Roundup. The equity market losses for the week were largely driven by Friday’s stock market rout, where the Dow, S&P 500 and Nasdaq composite posted their biggest weekly loss since early 2016; these leading equity indices experienced weekly declines of -4.1%, -3.9% and -3.5%, respectively. The impetus for the weekly losses can be attributed to different early and later week events. For instance, Amazon & Berkshire announced that they are collaborating to enter the healthcare industry, which rattled stocks in that sector early in the week, then on Friday investor jitters were related to: 1) tech darling earnings disappointments (APPL Iphone X, GOOG losses, etc.); 2) signs of inflation with the jobs report (treasury bond yields spiked); and, 3) the GOP memo showing further divisiveness amongst our country’s leadership. The message we would like to send to our clients is that we consider these corrections as healthy consolidations, which are normal market cycle episodes – also, from our calculation, the market is about 5-6 months overdue for its normal correction cycle which typically occurs every year and half.