-October 5, 2018 Weekly Capital Market Update. For the week, the S&P 500 was down about -1.0% and the Dow was flat, while the Nasdaq was crushed, down -3.2% and marking its worst week since March 2018. We closely watch the stock-market 'fear gauge' which experienced its sharpest weekly surge in over 6-months; the VIX is on pace to rise 39%, or 4.7 points, to 16.82 and represents its highest level since March (though it remains below the long-term average between 19 and 20). In the U.S., Fed commentary highlighted the view that the economy remains healthy and provided guidance that future rate increases will be necessary to moderate inflation. Fed Chair Powell’s statement indicated the economy “is a long way from neutral at this point” which was interpreted by the market as a more hawkish sentiment. Consequently, the yield curve steepened as Treasuries sold off to where the 10-year U.S. Note rose 18 basis points to close at 3.23% (seven-year high). Reported unemployment fell to 3.7%, a low not seen since December 1969. While Wall Street remains mixed between bullish and slightly bearish, JPMorgan remains positive: “We still recommend investors to be overall overweight equities vs bonds. The current selloff in bonds is helping this trade cushioning the decline in equities,” JPMorgan Chase & Co.’s London office.

|

Investment Insights I Market Outlook & Investment News

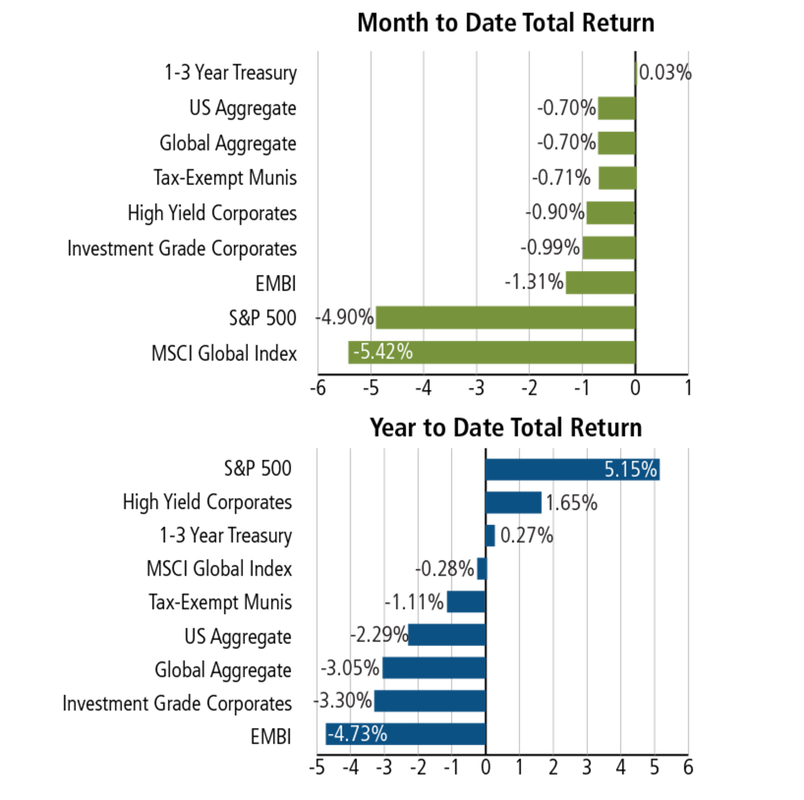

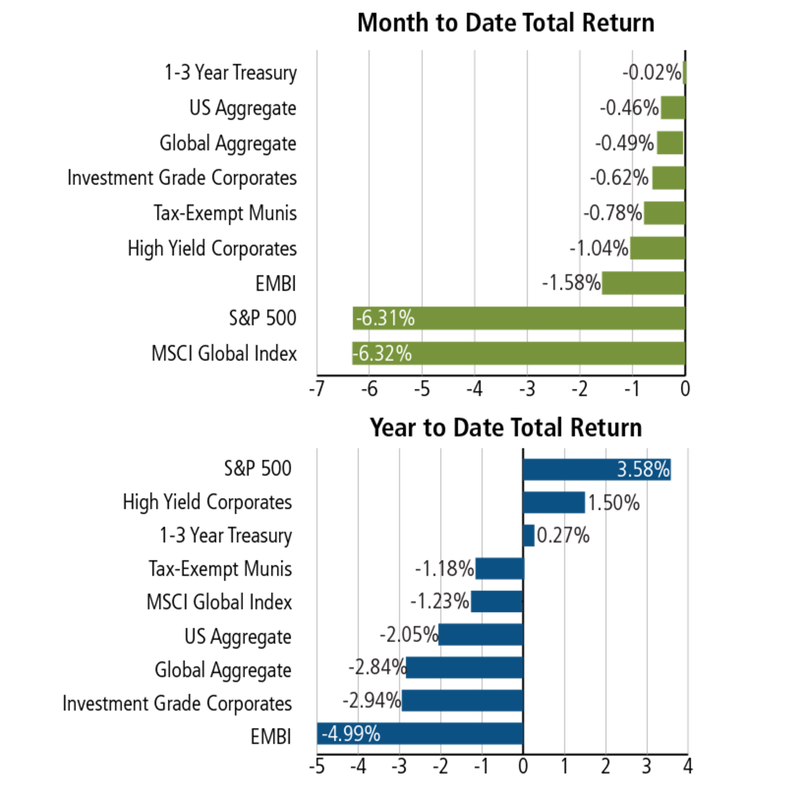

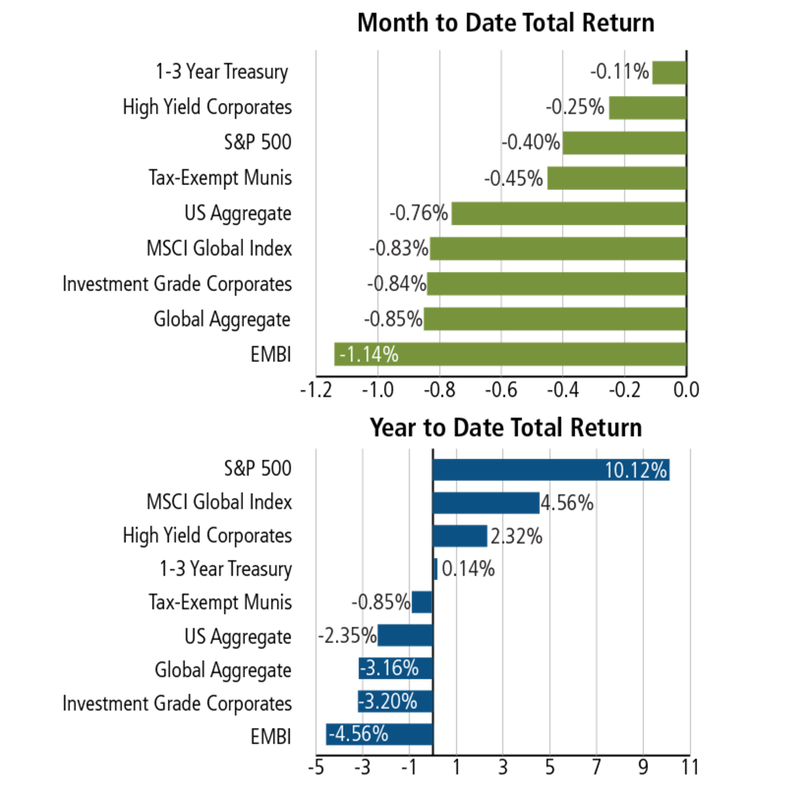

-October 26, 2018 Weekly Capital Market Update. The week was marked with volatility, furious trading and sharp stock market losses with the S&P 500 falling -3.94%, Dow Jones losing -2.97% and the dropping Nasdaq -3.87%. The broad S&P 500 market index hit "Correction" territory on Friday and is -10.5 percent below the all-time intraday high last reached Sept. 21, 2018. From a historical perspective, the average correction for the S&P 500 since World War II lasts four months and leaves equities down -13% before bottoming. In turn, bear markets losses average -30.4% and last 13 month (it takes stocks nearly 22 months on average to recover). Bear markets are technically triggered when equities fall -20% off the recent highs. The market losses were initially triggered by earnings rout in Tech darlings – such as Amazon & Google – that showed some earnings weakness. However, the stock market is also reflective of a general 'wheel of worry', including the combination of low unemployment, tariffs, a stronger dollar, rising rates and rising material costs – all which may signal that the markets have reached ‘peak earnings’. Furthermore, higher costs will dampen revenue and earnings growth going forward. Below, are the many potential drivers of this correction overhang: -October 19, 2018 Weekly Capital Market Update. The U.S. equity markets finished the week mixed with muted returns, yet trading continued to be choppy due to geopolitical events with the presumed fatal end to a journalist at the hands of a key U.S. ally, Saudi Arabia. For the week, the Dow Jones Industrial Average and S&P 500® Index eked out modest gains of +0.41% and +0.02%, respectively as the Nasdaq dropped -0.64%. Further, Wednesday’s release of Fed minutes of the most recent committee meeting revealed disparate opinions on future interest rate increases needed to maintain a neutral position. What is clear that broader macro factors continue to overshadow the fundamentally healthy economy given about 90% of the S&P 500® companies which have so far reported earnings have exceeded analyst estimates; moreover, company commentaries reveal limited impact of tariffs (so far). The U.S. economy continues to benefit from the fastest GDP growth in four years, the most robust corporate earnings growth in seven years, business and consumer confidence metrics that remain to multi-decade highs, unemployment at a half-century low, wages increasing at their fastest pace in a decade and retail sales running at their strongest pace in seven years. U.S. Leading Economic Index rose 0.5% to 111.8 in September, a fresh record peak and a little better than forecast while the IMF projects world growth of 3.7% this year and next. -October 12, 2018 Weekly Capital Market Update. The U.S. equity markets were rattled by turbulence this past week with the S&P 500 dropping -4.07%, the Dow Jones -4.17% and the Nasdaq -3.74%. While this was a broad-based sell off that negatively impacted all sectors in the S&P 500, from the macro standpoint the antecedent was really two-edged since the biggest drag on equities has been U.S. growth (followed by investment appetite for international risk). Indeed, the repricing of U.S. growth was an overdue gut-check predicated by the Federal Reserve instituting a restrictive period of rising rates (& less stimulus) which has historically been correlated with lower average returns for equity markets. However, the direction of Fed actions has been telegraphed for some time and while in the short-term, rising rates will also negatively impact bond prices, the longer-term outlook for bond investors may be positive due to higher yields going forward. Other drivers for market jitters relate to international trade, lower oil prices and pre-earnings announcements. For example, as we move into Q3 earnings season, tariffs are an emerging topic in earnings reports and executive commentaries. -October 10, 2018 Market Update. After a long stretch of relative calm, the stock market suffered sharp losses over the week. Stocks had come close to big drops in the last few days, but each time they recovered some of their losses. That didn't happen today. The S&P 500 logged the longest losing streak in two years (-3.3% today), while the Nasdaq posted the biggest drop (-4.1%) for 2018; it has fallen -7.5% in just five days. Our focus at this stage is on client portfolio correlation to these negative market events and it appears our firm’s diverse strategies have helped mitigate client exposure to losses. For example, our client portfolio loss range was around -0.50% to -1.25% (depending on each client's risks/goals) which demonstrate our diversity has held against adversity. Concerns about rapidly rising interest rates have helped lead to a selloff in the stock market. The biggest driver for market instability over the last week has been interest rates, which began spurting higher following several encouraging reports on the economy. Higher rates can slow economic growth, erode corporate profits and make investors less willing to pay high prices for stocks. The Fed has raised its benchmark rate three times already this year, most recently at the end of September and the Central bank meets two more times this year; we expect one more rate hike for the year. Also, energy investors reacted to shutdowns caused by Hurricane Michael in Florida and the Gulf of Mexico. Finally, U.S. tariffs on steel, aluminum and Chinese goods are another factor that could drive up costs and force companies to lower their forecasts. Market retrenchment and volatility is nothing unusual after a string of monthly gains. We continue to closely monitor the various considerations behind market behavior. At this stage, we have not processed any information that would indicate a break toward bear market trends.

-October 5, 2018 Weekly Capital Market Update. For the week, the S&P 500 was down about -1.0% and the Dow was flat, while the Nasdaq was crushed, down -3.2% and marking its worst week since March 2018. We closely watch the stock-market 'fear gauge' which experienced its sharpest weekly surge in over 6-months; the VIX is on pace to rise 39%, or 4.7 points, to 16.82 and represents its highest level since March (though it remains below the long-term average between 19 and 20). In the U.S., Fed commentary highlighted the view that the economy remains healthy and provided guidance that future rate increases will be necessary to moderate inflation. Fed Chair Powell’s statement indicated the economy “is a long way from neutral at this point” which was interpreted by the market as a more hawkish sentiment. Consequently, the yield curve steepened as Treasuries sold off to where the 10-year U.S. Note rose 18 basis points to close at 3.23% (seven-year high). Reported unemployment fell to 3.7%, a low not seen since December 1969. While Wall Street remains mixed between bullish and slightly bearish, JPMorgan remains positive: “We still recommend investors to be overall overweight equities vs bonds. The current selloff in bonds is helping this trade cushioning the decline in equities,” JPMorgan Chase & Co.’s London office. https://twitter.com/MontecitoCapMgt

Comments are closed.

|

Follow us on Twitter: @MontecitoCapMgt

July 2024

Categories |