-February 15, 2019 Weekly Capital Market Update. All U.S. equity markets rallied on the week marked by elevated positive expectations with U.S.-China trade talks and the avoidance of another government shutdown: S&P 500 gained +2.5%, Dow Jones +3.09% and Nasdaq +2.53%. The markets were also aided by Fed commentary reinforcing their intention to maintain liquidity near current levels. The market is also feeding off old economic news as related to fourth quarter 2018 earnings where the S&P 500 ($SPX) is reporting earnings growth of 13.1% for Q4 2018, which would be the 5th straight quarter of double-digit earnings growth. The S&P 500 has recovered from its lows and now site about 6% off the all-time-highs. However, our investment approach has used this impressive Jan-Feb rally to reduce market exposure; we will continue to feather down equity weightings should the market march upward. We believe the market valuations have gotten ahead of themselves (doesn’t mean it won’t go higher) given most of the good news is backward looking. In fact, the S&P 500 EPS estimate for Q119 has declined by -4.8% over the past 12 months and by -5.4% since Dec. 31 and the Conference Board’s Measure of CEO Confidence plunged -13 points to 42 in last year’s 4th quarter; this is the 3rd consecutive drop & now below key recession level of 43. Forward-looking data considerations should take consideration of that fact that more than half of the banks that reported earnings noted tighter standards due to an “uncertain economic outlook” and weak demand for loans. Therefore, we reiterate our stance of keeping powder dry for any market pullback, while also lower risk by investing in this (now) higher yielding fixed-income environment. Another cloud is uncertainties overseas: Brexit (U.K. economy 6-yr low), Italy’s slumbering economy & questionable leadership, economic unrest in France over taxes, etc.

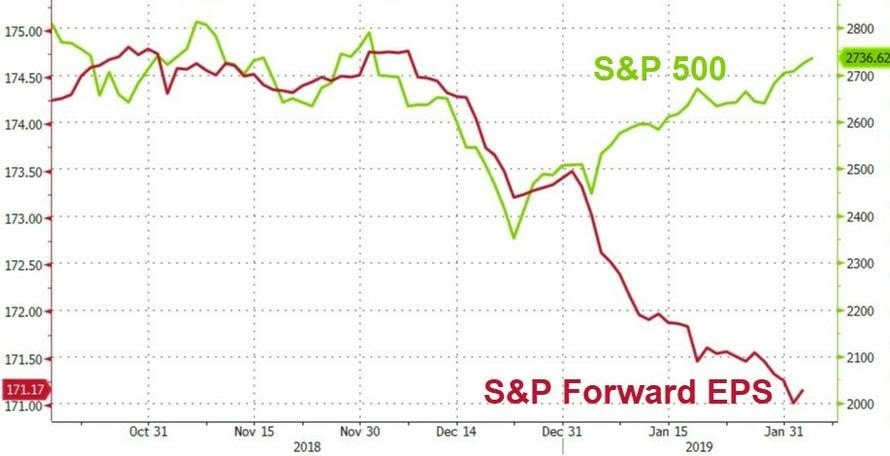

-February 6, 2019 Weekly Capital Market Update. The major equity indices nudged forward with a week marked by increased volatility: S&P 500® Index +0.05%, Nasdaq gained +0.55%, and Dow Jones Industrial Average +0.17%. The markets started the week on a positive trend then were rattled by Brexit and trade concerns. For example, President Trump said that he would not meet with China's President Xi before a March 1st deadline set by the two countries to achieve a trade deal. The remarks dampened growing optimism for a trade deal in the short term and weighed on stocks. However, fundamentals seem intact with earnings results from 66% of companies in the S&P 500 showing growth rate of 13.3%; on pace for a fifth consecutive quarter of double-digit growth. Market focus will continue on earnings reports and the expected Congressional action to avoid another government shutdown which could take effect on February 15th. The S&P now sits 7+% off the all-time highs, and investors are struggling to determine whether the markets can complete the "V" type of recovery from December lows. We reiterate our approach of incrementally phasing down risk during periods of market strength – lowering equity exposure through 2019. The rationale is we expect elevated economic headwinds in 2020 and the market prognosticator will react to any negative events months ahead of the hard data. Case in point, FactSet has revised their S&P 500 2019 year earnings and revenue forecast to +5%, which is far below past periods of double digit growth and certainly inconsistent with expanding equity valuation multiples [see chart below]. From the technical standpoint, sentiment remains positive as buyers have stepped in toward the end of the market trading day to help buy up the dips. Final thought is the market has built in expectations for a high level of corporate stock buybacks in 2019 – probably at least over $600 billion – but Congress has recently indicated intervention to curb this activity. We contend that buybacks are indeed often ineffective use of corporate piggybanks (should go to dividends and capital expenditures), but at the same time this mechanism has been supportive of equity market valuations and should it taper, then equity markets will lose a powerful buyer constituent of stocks.