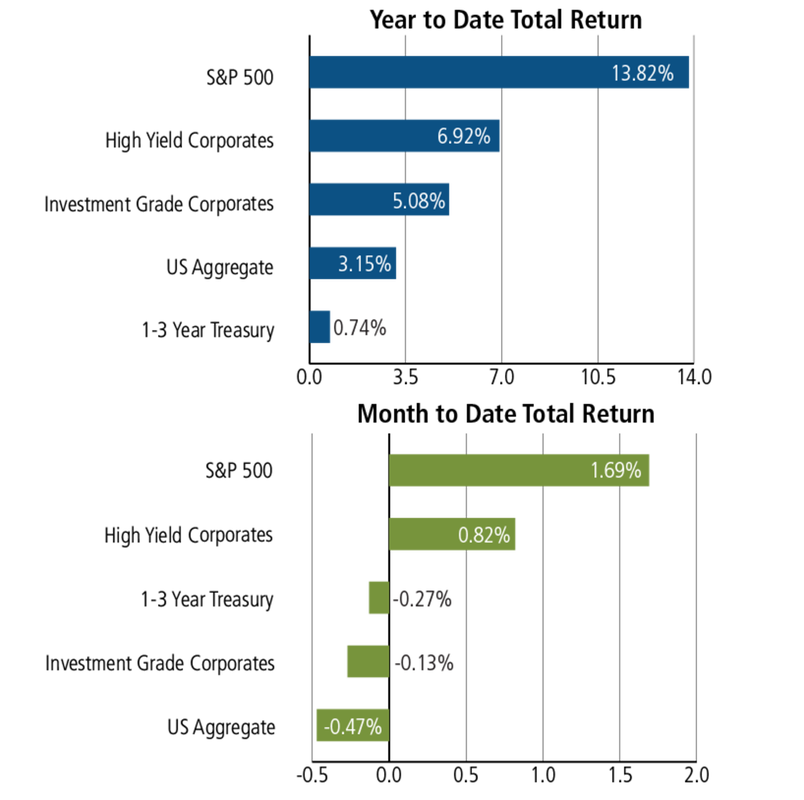

With regard to the multi-asset returns through mid-week, see the follow chart below:

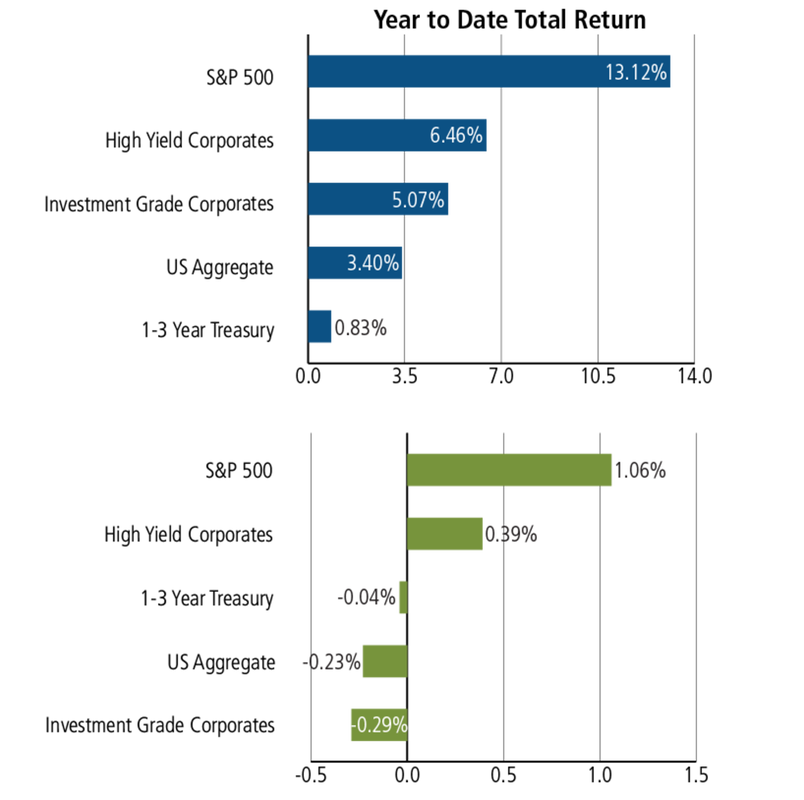

Below are index returns as of the market close for mid-week:

-September 1, 2017 Weekly Market Roundup. Equity markets bounced back for the week on several economic upside developments including 2Q GDP revised upward to 3.0% growth, wholesale inventories +0.4%, August employment change +237k (vs. +180k est), personal income +0.4% (vs. 0.3% est) and ISM manufacturing (58.8 vs 56.8 est). Further, the capital markets positively responded to Trump’s tax reform push highlighting simplified tax codes, lower taxes and repatriating offshore corporate cash hoards. For the week, the S&P 500 gained +1.43%, the Dow Jones +0.88% and the Nasdaq ended +2.71%.

-If history is any guide, September might be a tough market for stocks; it is historically the worst month for equities and the only one with statistically significant negative returns. Stocks have already receded -3% this summer and in our opinion, a bit more correction and consolidation is due.