-July 21, 2017 Weekly Market Roundup. Markets were mixed to slightly up this week with the S&P 500 +0.56%, Dow Jones 30 -0.22% and Nasdaq +1.19%. Utilities and Health Care were the best performing sectors, which were largely driven by falling interest rates. In turn, Energy and Industrials dropped for the week. Of the 97 companies in the S&P 500® Index that have reported second quarter earnings results, 71% have exceeded sales estimates and 72% have exceeded earnings estimates. An economic data point to solid growth was housing starts +8.3% in June.

-July 14, 2017 Weekly Market Roundup. The equity markets rallied this week on more dovish comments by Fed Chair Yellen and an optomistic start of earnings season. The S&P 500, Dow 30 & Nasdaq finished the week up +1.42%, +1.04% and +2.58%, respectively. Thus far, 30 companies in the S&P 500 Index have reported results; 87% have met or exceeded analysts’ earnings expectations.

-July 7, 2017 Weekly Market Roundup. Domestic equity market indexes slightly improved during the week with the S&P 500, Nasdaq & Dow up +0.14%, +0.21% and +0.38%, respectively. However, bonds lost ground during this period with the US Core Bond Index losing -0.36%, while the US Government Bond Index lost -0.44%. As we move further in the second half of the year it looks more likely that the global central banks are poised to raise interest rates or otherwise tighten monetary policy as economies improve. Historically, rising rate cycles correspond with improving economic conditions and last a span of about two-to-four years. However, gradual incremental rate cycles are often accompanied by a continuation of a bull market. For example, the current cycle began in December 2015 when the Fed Funds rate rose from 0.25% to 0.5%, so based on this theory we would potentially remain in a midst of the bull market. In the U.S., the ISM Manufacturing Index for June reached its highest level since August 2014.

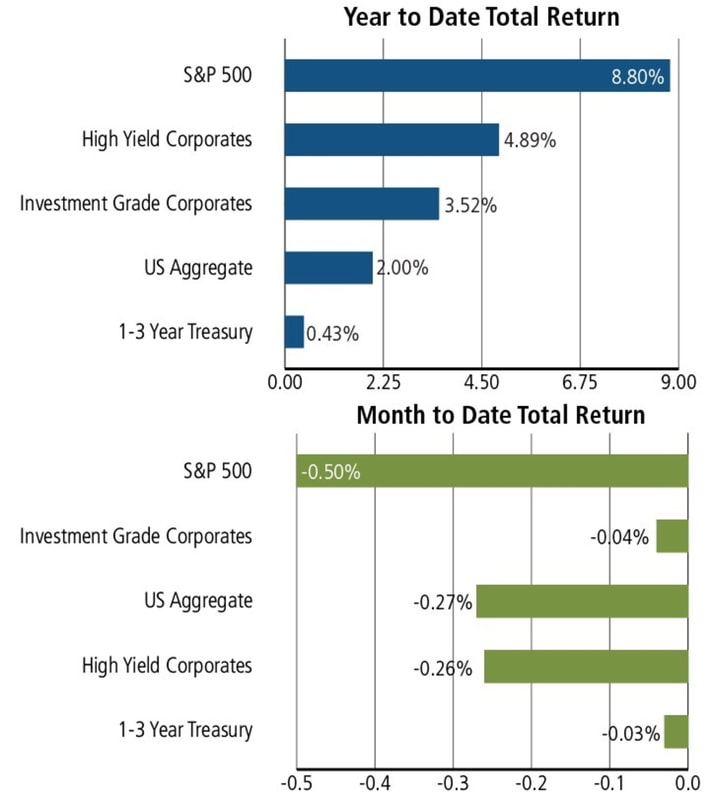

Below is a mixed index summary of returns for the year and month-to-date: