-Our clients keep asking, "Can these nosebleed high equity valuations last, have these types of elevated price-earnings ratios occurred before with the S&P 500, particularly without some type of market correction (-10% range)?" The answer is "Yes, but with a caveat." First the good news, I turn you to the mid-1990s as an example of a high valuation period when strong earnings growth, which helped keep significant downside events out of the market. More specifically, from December 1991 through December 1994, the S&P 500 Index earnings grew more than 20% annualized. The trailing 12-month P/E began the period at 15.35, climbed above 20 by mid-1991 and stayed above that threshold until the first quarter of 1994. During this same period, the worst peak-to-trough decline in the S&P 500 Index was a drawdown of -8.47% (from February 2, 1994 to April 4, 1994). Putting this historical perspective aside, we still look for greater market volatility in 2018. In fact, a sharp rise in volatility would not necessarily require a deterioration in corporate earnings or economic conditions.

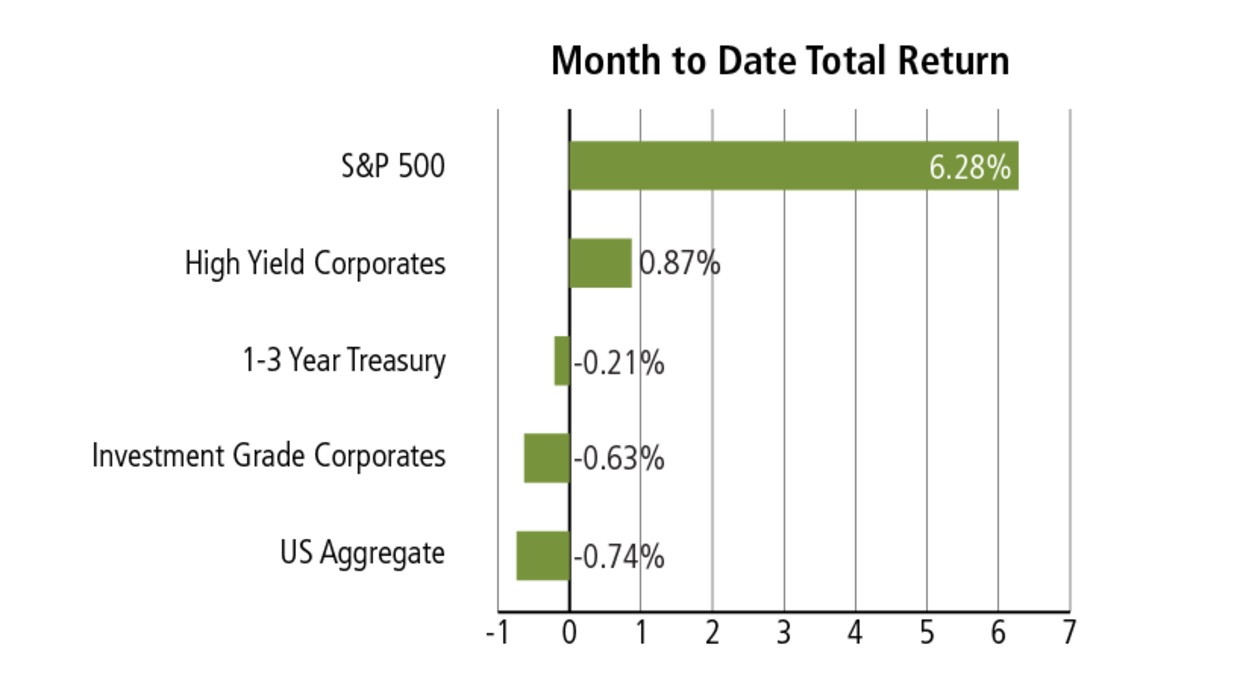

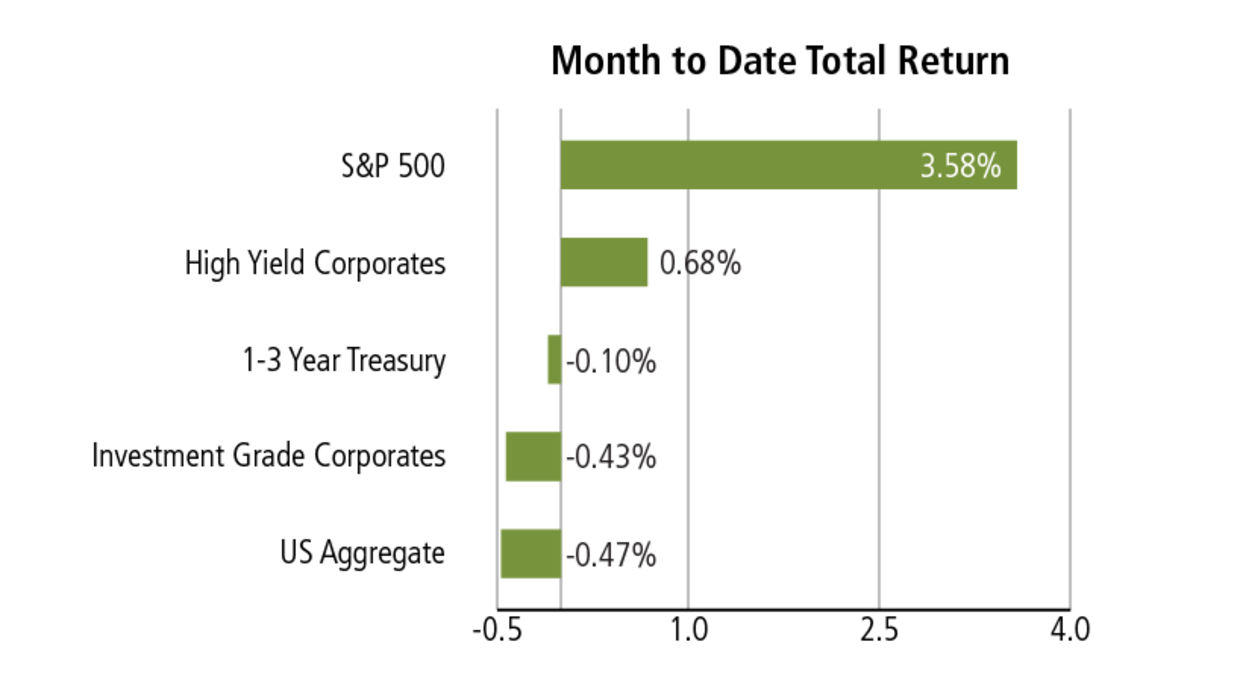

-January 12, 2018 Weekly Market Roundup. The U.S. equity markets posted another week of strong returns as bullish investor sentiment propelled major stock indices to new record highs. The S&P 500 gained +1.64%, the Dow Jones +2.01% and Nasdaq +1.89% for the second week of January. At the same time, US Aggregate Bond Index, Investment Grade Corporates and 1-3 Year Treasury continue to experience price weakness with the overhang of an anticipated 2-3 rate hikes this year. That said, we reiterate our bullish equity outlook for 2018 and though we anticipate increased volatility, we are steadfast in our views of, at least, high single digit positive equity returns.

-Our Community Mudslide Devastation, A Personal Note: First, while we have experienced technical and logistical pitfalls from the tragic mudslide & debris events surrounding our community, our health has been unaffected. We also have had workarounds in place to mitigate the cable/wireless/power/telephone disruptions and our system continuity measures have provided for ongoing monitoring and adjustments of client portfolios. However, at times, we had no access to the Santa Barbara office due to the Highway 101 damage and this has necessitated client account maintenance to be handled remotely. We are heartbroken over the horrifying catastrophic destruction and great loss of life in Montecito. Our prayers and condolences continue to go out to those in our community that have experienced hardship and loss.

-The S&P 500 Index has gone 382 days without a 5% pullback, putting it just over two weeks away from the longest streak on record, dating back to 1929. In 2018, our client portfolios will have increased weightings overseas where valuations are over 20% cheaper, growth is intact, central banks remain accommodating and earnings are accelerating. In fact, just a mere 3% of overseas country economies are expected to encounter any form of contraction, which is the fewest foreign countries in recession on record.

-2018 STOCK MARKET FORECAST - S&P 500 EQUITY INDEX PREDICTION: There has been a lot of talk about how the equity markets have been induced by artificial liquidity injections by the Federal Reserve. Insofar as we believe in “don’t fight the Fed,” at the same time it is also the people’s money and institutional money that has been driving this rally, along with benign inflation, relatively low interest rates and strong corporate profit trends. Based on about a dozen 2018 stock market predictions by Wall Street’s strategists the average S&P 500 target is +7.8% return, or a +209 gain to 2,883. Our internal forecasts are also (at least) high single digit returns, however, the forecasts by the top U.S. investment houses came with wide disparity on where stocks are headed. The most bullish year-end price target for the S&P 500 is 3,100, or nearly 16% higher than its current level of 2,674. The least optimistic prediction is 2,750, which represents a gain of about 2.8%. Keep in mind that company stock buybacks are expected to add about +2% to total returns alone this year. Also, following years like 2017 marked by above-average new highs and below-average volatility, volatility has historically picked up in subsequent years to rival the normal average of 50 big-movement days. Wall Street Strategist are also looking for double-digit earnings growth via high profit margins for the S&P 500 in 2018. For example, as of December 22, analysts estimate the earnings growth rate for the S&P 500 for calendar year 2018 to be +11.8%.