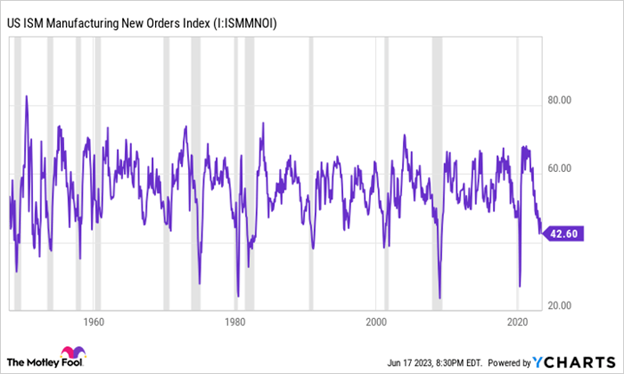

June 23, 2023, Weekly Stock Market Return Recap. The stock market reacted negatively to Fed Chair Powell’s statements this week with the S&P 500 and Nasdaq both ending down 1.4% and the Dow Jones falling 1.8%. The broad market index of the S&P 500 decline was the largest since March with most trade days finishing in the red on the week. Powell’s remarks at a House Financial Services Committee hearing Wednesday were perceived as hawkish, characterized with statements “The process of getting inflation back down to 2 percent has a long way to go” and “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.” The week’s economic news was highlighted by ISM’s Manufacturing New Orders Index which contracted for the ninth consecutive month in May, registering 42.6 percent, a decrease of 3.1 percentage points. Historically, declines below the 43.5 range in the ISM New Orders Index have been a reliable signal of impending U.S. recessions. Indeed, out of the more than one dozen occasions where the ISM Manufacturing New Orders Index has below 43.5, only one proved to be a false-positive for a U.S. recession, and that occurred way back in the 1950s. Another factoid is should a U.S. recession occur, history would suggest that the Dow, S&P 500, and Nasdaq Composite have yet to reach their true bear market lows, as no bear market after World War II has bottomed prior to an official recession being declared.

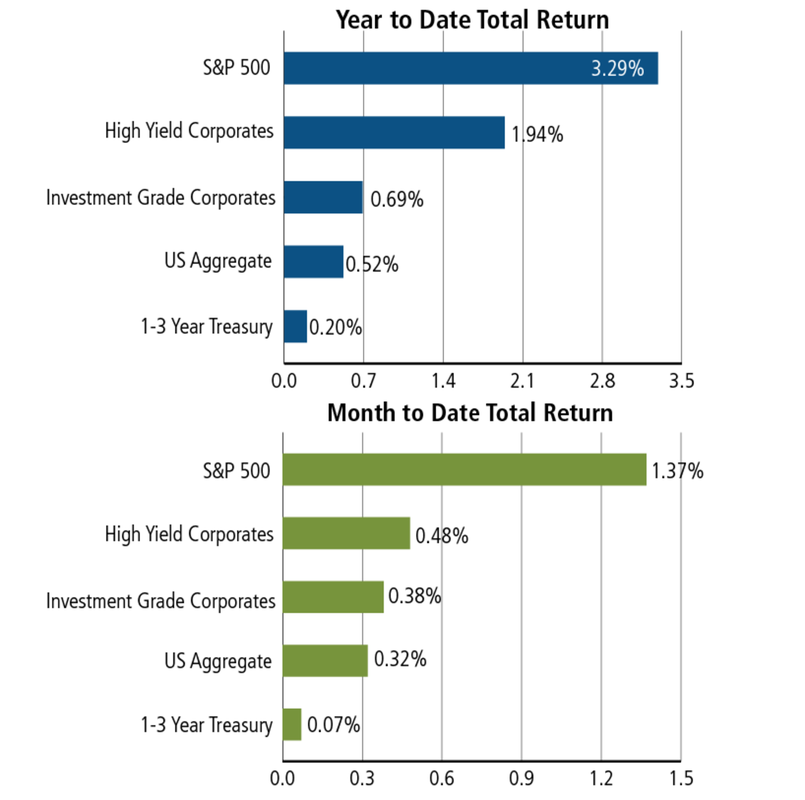

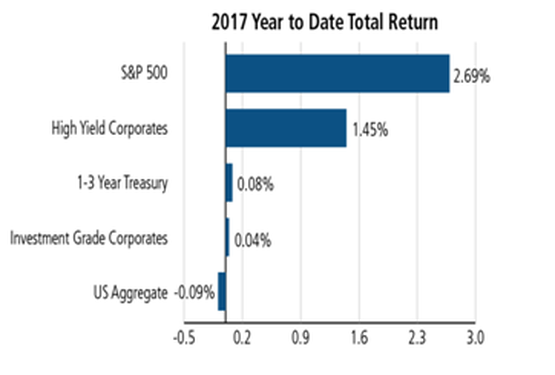

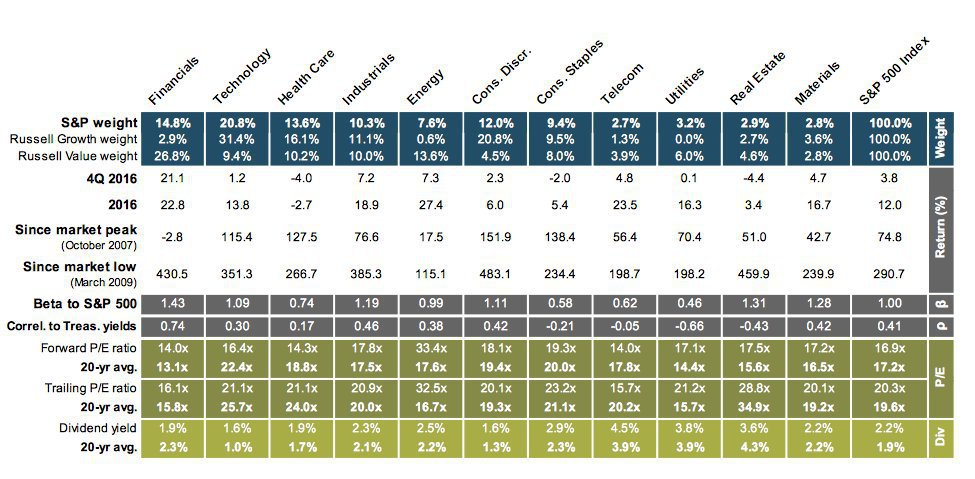

June 16, 2023, Weekly Stock Market Return Recap. On a bullish Fed rate pause, the S&P 500 finished up +2.6% on the week, marking its best performance since March of 2023. After 10 consecutive interest rate hikes over the past 15 months, the Federal Reserve finally decided to pause during Wednesday’s Fed meeting. This rate pause will give the Fed further time to process incoming economic data and inflation. Yet, it might be premature to take out the party bowl as the Fed’s decision comes with the projection of another two 25 basis point rate hikes ahead in 2023; this would move the benchmark rate into the 5.50% and 5.75% range. The market probability tracker shows that the central bank’s future rate hikes have about a 60% chance the Fed will hike rates by 0.25% in the next July meeting. Back to the equity markets, it is important to highlight the unhealthy balance in the S&P 500 recovery, as the concentration of stock leaders is the most concentrated since 1970’s. Indeed, seven tech stocks – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta – have accounted for most of the S&P 500’s recovery with 40%-80% range bound gains, while the other 493 stocks are largely flat in aggregate. Moreover, the top five stocks now represent nearly one-quarter of the S&P 500 market capitalization. Those lopsided percentages are even higher than at the peak in the dot-com bubble of 2000, where the market lost 43% of its value over three years. Unless the breadth of stock participation in the rally expands, this does not bode well for the sustainability of the stock market recovery. Therefore, client portfolios will remain diversified with neutral risk standing until which time we see both more supportive economic data and broader market sector participation in stocks.

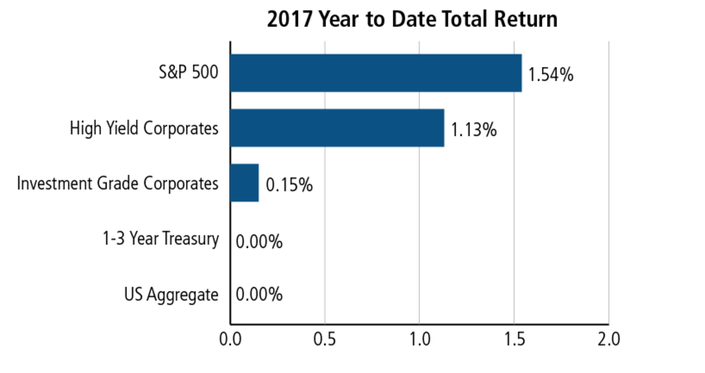

June 9, 2023, Weekly Stock Market Return Recap. Stocks rose on the week moving the S&P 500 broad market index into new bull market territory with a +20% recovery from the lows back in October of last year. For the week, the S&P 500 finished up 0.4%, the Dow gained 0.3% and the Nasdaq eked out 0.1%. However, over one half of the 11 sectors in the S&P 500 are still in the red, while Information Technology (+35%) and Communication Services (+33%) sectors are largely carrying the index upward on the year. Yes, insofar as the sector participation breadth has increased in June from previous months, the fact that technology and to a smaller part, consumer discretionary, are driving the positive equity index market gains on the year is a sign the lingering problems for the prospects of a healthy, sustainable bull market.

June 2, 2023, Weekly Stock Market Return Recap. Stocks buoyed on jobs data and debt default averted. For the week, the S&P 500 rose 1.82%, the Dow added 2.02% and the Nasdaq gained 2.04%. A lot of positive developments on the week with the government debt ceiling suspended for two years and unemployment jumping to a seven-year high at 3.7%; in particular, the easing of labor spiked sentiment that the Federal Reserve may skip a rate hike in two weeks.