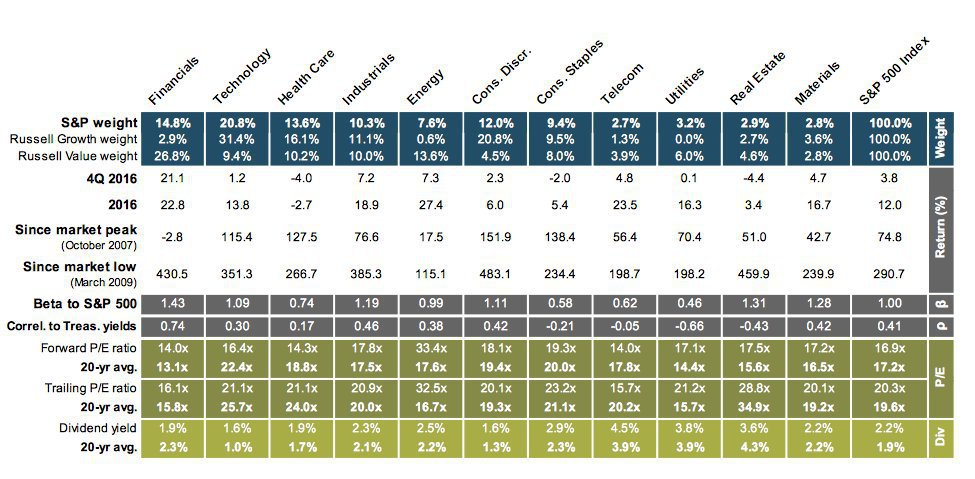

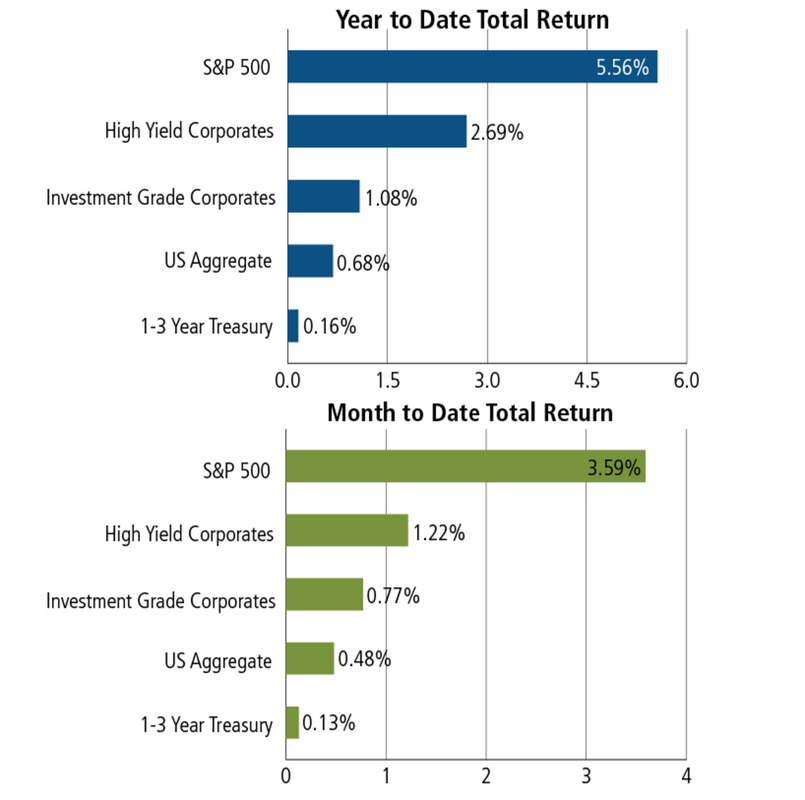

-February 24, 2017 Weekly Market Roundup. U.S. equity markets continued hitting records this week — including 10 day record of closing highs in a row for the Dow Jones as of 23 February. The U.S. equity market climbed modestly higher in a holiday-shortened week. Investors gravitated towards conservative areas of the market, with utilities being the strongest performers followed by consumer staples companies, such as food and beverages. With the fourth quarter earnings season now behind us and a relatively light week of corporate headlines, investors’ were squarely focused on the new Administration’s corporate tax reform. Equity markets remain optimistic that Trump will cut taxes, reduce regulation and implement a sweeping infrastructure spending program. The S&P 500 Index is up +5.3% year to date and has gained over +21% over the past 12 months. The yield on the 10-year US Treasury bond fell -2.9% this week to 2.34%

-Below is the summary of potential Trump’s tax reform proposals which appear on the surface to be pro-economic growth, bullish for equities and corporate net profits:

- Reduce Capital Gains and Dividend Tax Rates from current high of 20% to 16.5%

- Eliminate Carried-Interest Deduction (taxed at ordinary income)

- Collapse the seven current individual brackets into three brackets 33%, 25% & 12%: a top rate of 33% ($112.5K+ individual and $225K+ joint); 25% under $112.5K individual/$225K joint; and 12% for those earning under $37.5K individual/$75K joint

- Eliminate 3.8% Obamacare surtax on investment income

- Eliminate Estate Tax and Alternative Minimum Tax (AMT)

- Expansion of EITC/CTC Tax Credits for lower-income Americans (potentially extra $1000+ per month for working-poor)

- House GOP plan eliminates all itemized deductions besides the mortgage interest deduction and the charitable contribution deduction (raises $2.3T over 10 years)

–Two technical factors may lend support to asset valuations and provide a cushion against the slew of event risks looming this year: First, in a recent study, JPMorgan highlighted that there was a decline in equity supply last year & this created support for equity markets. This trend is anticipated to be an accommodating mechanism in 2017 as global equity supply should further shrink with share buybacks, mergers and leveraged buyouts. Second, net supply of new U.S. investment-grade debt could decline by as much as 31 percent to $511 billion in 2017 thanks to a wave of maturing bonds and coupon payments, according to Bank of America Corp’s calculation. In short, altogether there appears to be less equity supply and more cash coming into play which should bode well for lofty equity valuations. Moreover, there is another component – Wall Street firms (such as RBC) expect corporate earnings to “re-accelerate” to 7.8% growth with profitability being fuelled by an improved operating environment for “financials, less –onerous regulations, and energy.”

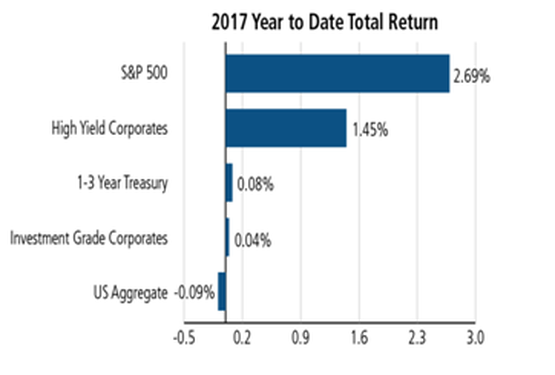

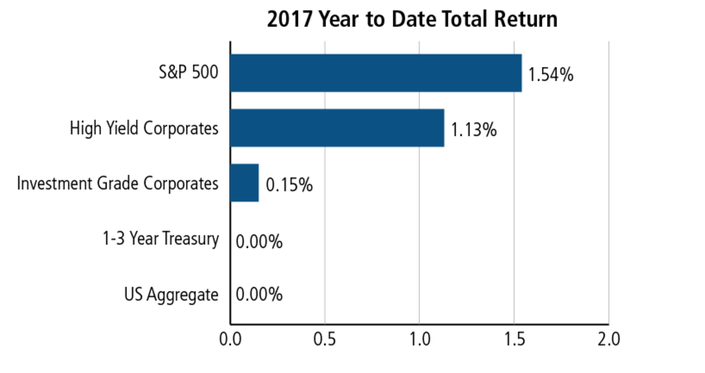

-February 3, 2017 Weekly Market Roundup. Markets rebounded from early losses to end the week roughly flat with the S&P 500 adding +0.1 percent to 2,297.42 on the week as the Dow Jones Industrial Average lost -0.1 percent to 20,071.46. More than half of S&P 500 companies have reported earnings and profits are beating expectations by an average 3.3 percent, even as revenue figures fall in line with analyst projections. Earnings are up 5.5 percent on average (the first time EPS growth for two consecutive quarters since 2015) with eight of 11 industry groups posting gains. Friday showed the U.S. added 227,000 net new jobs in the month of January. Relative to expectations, top-line job growth surprised to the high side and continued to impress. The 3-month moving average is 183,000—a good sign for economic growth, stocks, and credit.

-A recent study by FinMason found that a whopping 43% of investors do not know what risk tolerance is and 73% of the survey respondents indicated that their advisor never discussed or explained the potential for portfolio losses that could occur with another big market crash. A conversation explaining volatility, particularly downward portfolio moves, and how it can be controlled through asset allocation is the best way to approach the understanding. For example, we show clients that equity declines of -5% or more are quite frequent at three times a year on average, while -10% or more occur about once a year and -15% or more once every two years on average. Bear market events with equity losses exceeding -20% or more are infrequent, occurring every 3.5 years and lasting about a year in duration. Portfolio diversification may help reduce risk, and the lower the correlation between returns from different securities in a portfolio, the greater the diversification benefit. Successful diversification depends upon combining asset classes that are not perfectly correlated.

–Today (2/1/17), the FOMC left its target range unchanged at 0.50%–0.75%, and reiterated that “gradual increases” in the federal funds rate are still planned. There also appears to be a bias of no move for the March meeting. The only new issue mentioned concerned consumer and corporate sentiment, which were noted to “have improved of late”. The 10-year Treasury notes are highly sensitive to small changes in interest rate expectations. This can be beneficial when interest rates are declining, but quite the opposite when interest rates are on the rise. After returning +8.0% during the first half of 2016, 10-year U.S. Treasury notes returned -7.5% during the second half of the year as their yields rose by more than 1%.