Portfolio Management Strategies - A Path of Diversity to Manage Risk

Montecito Capital Management's focus is on the active management of multiple investment asset classes based on modern portfolio practices and economic/market prospects. Active managers can succeed in three disciplines: market timing, security selection and portfolio construction. We emphasize a diversified portfolio approach to minimize portfolio volatility and to deliver a personalized investment management service that seeks to maximize the net-of-fee, after-tax, real investment return for each client’s particular tolerance for risk. There are many effective strategies that have produced successful long-term results. The key to success is to find and implement the strategy that best fits your own unique goals, objectives, needs, and most importantly - risk tolerances.

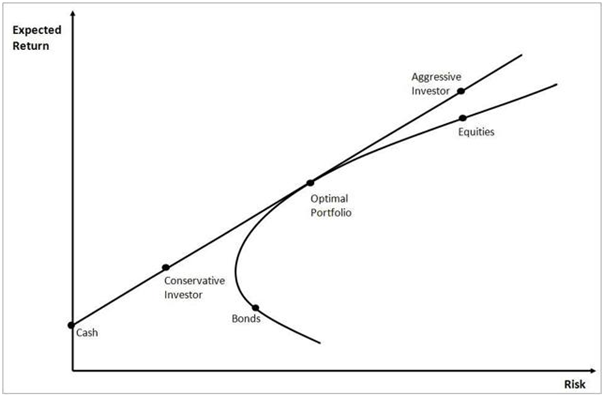

The basic principles in which we apply to manage financial assets is to never over concentrate allocations to any one investment, only hold those investments that offer the prospect of a reasonable return and accept that financial markets will behave in ways that confounds the majority of investors. These principles are guided by the importance of portfolio diversification, maintaining reasonable expectations and avoiding the latest fads. We employ asset diversification strategies to manage risk, but this does not guarantee against loss - rather, it is designed to help mitigate the magnitude of potential losses. Investors need to understand and accept the reality that there is a trade-off between the level of returns, income and risk.

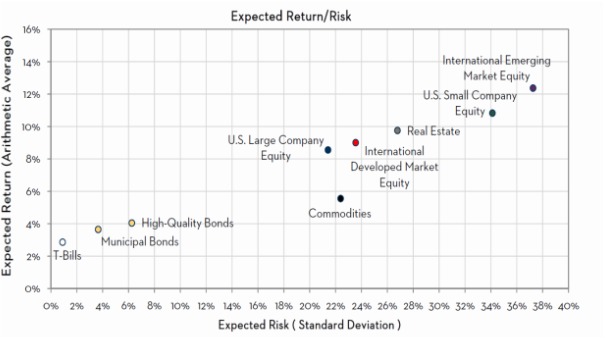

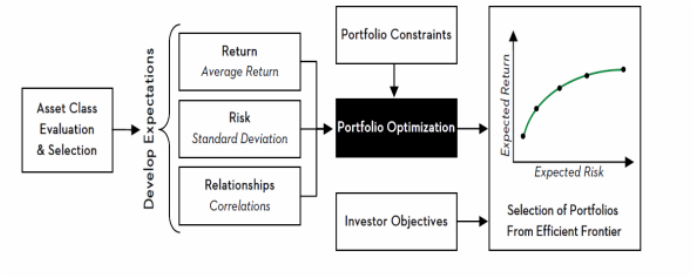

We evaluate asset classes by focusing on three characteristics: return, risk and correlation. Utilizing these three primary characteristics as a basis for evaluating asset class portfolio benefits provides a framework to deal with the inevitable trade-offs in selecting asset classes. Portfolios should include asset classes that react differently to different economic environments and that can help mitigate portfolios from unexpected negative market events. Asset classes should be distinct, clearly defined and offer specific benefits to portfolios. Examples of asset classes include domestic & international stocks, preferred stocks, diverse types of domestic & international bonds, convertibles, REITs, liquid commodities, liquid precious metals, non-energy MLPs, a number of alternative strategies and so forth.

We emphasize a diversified portfolio approach to minimize portfolio volatility/risk with an aim to optimize risk-adjusted returns. Unlike the typical money manager who focuses on only two asset classes such as equities and bonds, we work with many asset categories that have unique investment properties in an effort to smooth a portfolio's path through treacherous market gyrations. Typically stocks and bonds are negatively correlated, but because of quantitative easing, they were positively correlated, compounding investors’ returns during the bull market following the financial crisis. The essence of this approach is to identify the best (low expense, no load) managers, stocks, bonds, ETFs, etc. for each asset class - capturing the optimal 'alpha' or portfolio manager performance premium - coupled with exposure to low correlated asset classes that have limited covariance around a target return.

As one investment leader puts it (Gibson), ‘the multiple-asset class strategy is a tortoise-and-hare story. Over any one-year, three-year or intermediate-term period, the race will probably be led by one of the component single-asset classes. The leader will, of course, attract the attention. The tortoise never runs as fast as many of the hares around it. But it does run faster on average than the majority of its components, a fact that becomes lost due to the attention-getting pace of different lead rabbits during various legs of the race... Yet the tortoise, in the long run, leaves the pack behind. And in case the analogy was lost on anyone, the hare is the single-asset class domestic (high growth) stocks, for instance - whereas the multiple-asset class is the tortoise.’

The goal for a typical client portfolio is to have relatively higher correlation to up-market cycles and lower correlation to down market turns. This is a challenging balance and investors must first realize that total return is comprised of two important components: income or yield, and capital appreciation. These two factors play different roles during different market cycles. For example, income is more predictable and reliable, while capital appreciation can be subject to volatility. The diversity approach we subscribe to, however, goes beyond just income and capital appreciation, as we seek diverse attributes of many forms of income and appreciation. The goal is an optimal combination of many asset classes with diverse size, sector and country exposures: some move independent of the markets, some perform better in down markets, some move relative to economic cycles, or some correlate with inflation and others to interest rates. We apply financial models to accomplish a target return relative to the risk assigned. The types of asset classes are provided in the matrix chart towards the end of this informational narrative.

We also combine fundamental analysis of sectors, market capitalization and styles (value, growth etc.) with three types of data for each asset class, in each case based on historical and prospective data. They are: (1) Expected return, (2) Standard Deviation & Semi-Deviation (which is a measure of risk, based on the fluctuation of historical results around the mean & the deviation below the assets mean return) and (3) Correlation between asset classes (which measure the performance of one asset class relative to another). With the application of sophisticated financial practices and tools we work with the client to construct customized portfolios with the highest risk-adjusted return relatives to every client's unique goals, risk tolerance and individual constraints.

Successful fundamental investing requires a long-term view. For example, the advantage of investing into blue-chip dividend growth stocks with attractive investment merits stems from the growing dividend income stream that pays the sophisticated investor to wait for eventual price appreciation. This is especially appropriate for retirees whose primary objective is to earn a current and a growing future income stream. Investing for income in retirement is almost by definition, most appropriately a long-term portfolio approach and strategy.

As long-term investors, we consider short-term price volatility as an opportunity and high price valuations as risk. As investors select more aggressive portfolios, investment outcomes become less predictable. Another element of portfolio risk that is important to investors is the possibility of experiencing negative returns. This makes clear that investors should approach ongoing portfolio reviews with the idea of focusing primarily on the portfolio as a whole rather than the individual components that make up the portfolio which will experience losses from time to time.

To lower portfolio expenses, we also utilize individual stocks, individual bonds and exchange-traded funds for a portion of the pure equity and fixed income classes, then apply macro and fundamental analysis to overweight countries, sectors or yield curve segments. However, the methodology of using passive, lowest cost exchange traded solutions must be executed with prudence. We deem the blind use of ETF passive benchmarks to be inherently dangerous since engaging in 'herd behavior' often leads to holdings of the most 'trendy' companies, which may have absurd market values relative to the intrinsic fundamental value. For example, on March 31, 2000, "five of the top thirty stocks had a P/E (ratio) higher than 100, and nine more had a P/E between 50 and 100. The market capitalization (value) of the 14 largest companies with P/Es higher than 50 summed $3.2 trillion. . by September 30, 2002, the capitalization of the 14 largest companies had fallen by $2.5 trillion as part of an overall equity market decline that trimmed more than $6 trillion from the total US equity capitalization." (The Research Foundation of AIMR, Benchmarks and Investment Management, Laurence B. Siegal, 8/1/03. p. 37). This event illustrates the need for active management of asset classes - in this case, banking gains from equities by means of rebalancing toward other asset classes. Finally, we also take account and try to control for other ETF risk considerations such as liquidity, authorized participants mechanism issues, tax inefficiencies, etc.

A primary reason advisors are also including some liquid tradable alternative strategies (e.g. REITs, option protection, absolute strategies) in their clients’ portfolio is that they broaden diversification and give investors a risk/return profile different from that provided by equities, bonds or cash. We look at alternatives as portfolio diversifiers because they don’t have a high correlation with stocks or bonds and fit somewhere between the two in terms of risk profile. Another consideration is to evaluate the increased portfolio contribution of alternative assets when traditional assets like stocks and bonds are trading at lofty valuations.

In an effort to offset the costs of alternative styles, we also employ dynamic passive investment methods for the pure equity allocations via exchange traded funds or ETF (average expense 0.15%-0.25% or 15-25 basis points), along with buying individual stocks, diverse individual bonds, preferred issues, etc. With ETFs, we can choose between over 100 styles of ETF equity indices (focus on liquidity) and construct a portfolio that integrates a low-covariance between classes. We further optimize mean-variance with fixed income (TIPS, Corporate & Government bonds) and hybrid fixed income exposure (convertible, high-yield & mezzanine debt). So we’re emphasizing using various alternative strategies to help us manage risk.

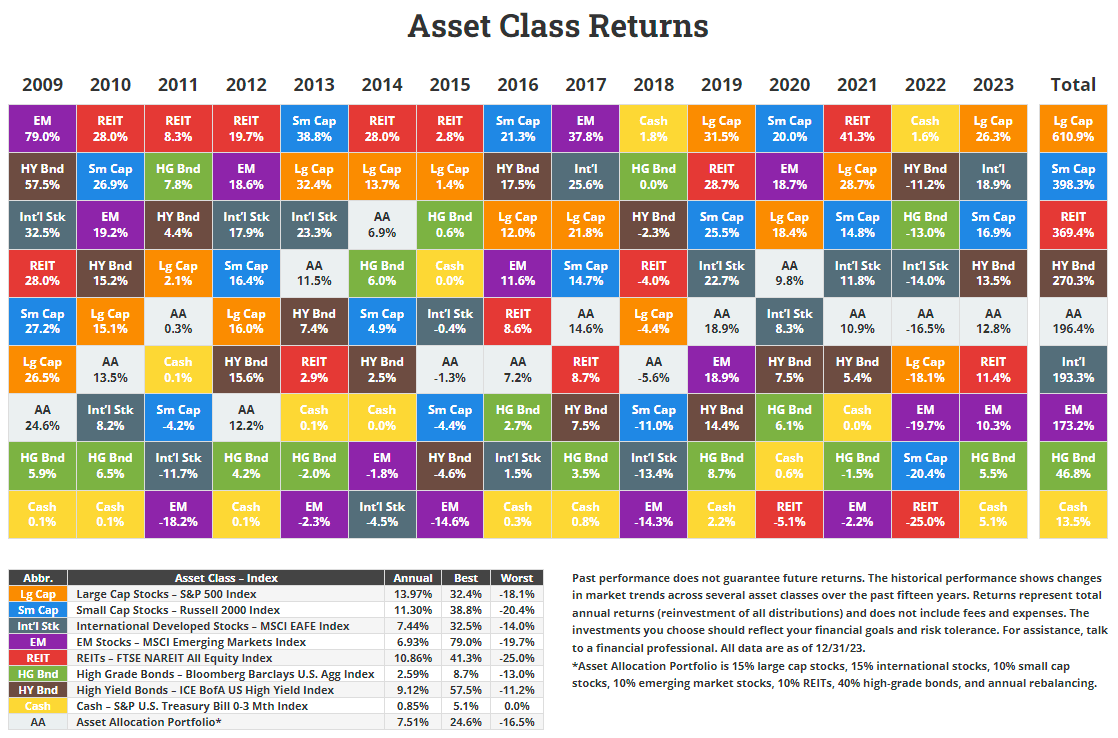

These two matrix charts show the immense asset diversity potential:

Montecito Capital Management's focus is on the active management of multiple investment asset classes based on modern portfolio practices and economic/market prospects. Active managers can succeed in three disciplines: market timing, security selection and portfolio construction. We emphasize a diversified portfolio approach to minimize portfolio volatility and to deliver a personalized investment management service that seeks to maximize the net-of-fee, after-tax, real investment return for each client’s particular tolerance for risk. There are many effective strategies that have produced successful long-term results. The key to success is to find and implement the strategy that best fits your own unique goals, objectives, needs, and most importantly - risk tolerances.

The basic principles in which we apply to manage financial assets is to never over concentrate allocations to any one investment, only hold those investments that offer the prospect of a reasonable return and accept that financial markets will behave in ways that confounds the majority of investors. These principles are guided by the importance of portfolio diversification, maintaining reasonable expectations and avoiding the latest fads. We employ asset diversification strategies to manage risk, but this does not guarantee against loss - rather, it is designed to help mitigate the magnitude of potential losses. Investors need to understand and accept the reality that there is a trade-off between the level of returns, income and risk.

We evaluate asset classes by focusing on three characteristics: return, risk and correlation. Utilizing these three primary characteristics as a basis for evaluating asset class portfolio benefits provides a framework to deal with the inevitable trade-offs in selecting asset classes. Portfolios should include asset classes that react differently to different economic environments and that can help mitigate portfolios from unexpected negative market events. Asset classes should be distinct, clearly defined and offer specific benefits to portfolios. Examples of asset classes include domestic & international stocks, preferred stocks, diverse types of domestic & international bonds, convertibles, REITs, liquid commodities, liquid precious metals, non-energy MLPs, a number of alternative strategies and so forth.

We emphasize a diversified portfolio approach to minimize portfolio volatility/risk with an aim to optimize risk-adjusted returns. Unlike the typical money manager who focuses on only two asset classes such as equities and bonds, we work with many asset categories that have unique investment properties in an effort to smooth a portfolio's path through treacherous market gyrations. Typically stocks and bonds are negatively correlated, but because of quantitative easing, they were positively correlated, compounding investors’ returns during the bull market following the financial crisis. The essence of this approach is to identify the best (low expense, no load) managers, stocks, bonds, ETFs, etc. for each asset class - capturing the optimal 'alpha' or portfolio manager performance premium - coupled with exposure to low correlated asset classes that have limited covariance around a target return.

As one investment leader puts it (Gibson), ‘the multiple-asset class strategy is a tortoise-and-hare story. Over any one-year, three-year or intermediate-term period, the race will probably be led by one of the component single-asset classes. The leader will, of course, attract the attention. The tortoise never runs as fast as many of the hares around it. But it does run faster on average than the majority of its components, a fact that becomes lost due to the attention-getting pace of different lead rabbits during various legs of the race... Yet the tortoise, in the long run, leaves the pack behind. And in case the analogy was lost on anyone, the hare is the single-asset class domestic (high growth) stocks, for instance - whereas the multiple-asset class is the tortoise.’

The goal for a typical client portfolio is to have relatively higher correlation to up-market cycles and lower correlation to down market turns. This is a challenging balance and investors must first realize that total return is comprised of two important components: income or yield, and capital appreciation. These two factors play different roles during different market cycles. For example, income is more predictable and reliable, while capital appreciation can be subject to volatility. The diversity approach we subscribe to, however, goes beyond just income and capital appreciation, as we seek diverse attributes of many forms of income and appreciation. The goal is an optimal combination of many asset classes with diverse size, sector and country exposures: some move independent of the markets, some perform better in down markets, some move relative to economic cycles, or some correlate with inflation and others to interest rates. We apply financial models to accomplish a target return relative to the risk assigned. The types of asset classes are provided in the matrix chart towards the end of this informational narrative.

We also combine fundamental analysis of sectors, market capitalization and styles (value, growth etc.) with three types of data for each asset class, in each case based on historical and prospective data. They are: (1) Expected return, (2) Standard Deviation & Semi-Deviation (which is a measure of risk, based on the fluctuation of historical results around the mean & the deviation below the assets mean return) and (3) Correlation between asset classes (which measure the performance of one asset class relative to another). With the application of sophisticated financial practices and tools we work with the client to construct customized portfolios with the highest risk-adjusted return relatives to every client's unique goals, risk tolerance and individual constraints.

Successful fundamental investing requires a long-term view. For example, the advantage of investing into blue-chip dividend growth stocks with attractive investment merits stems from the growing dividend income stream that pays the sophisticated investor to wait for eventual price appreciation. This is especially appropriate for retirees whose primary objective is to earn a current and a growing future income stream. Investing for income in retirement is almost by definition, most appropriately a long-term portfolio approach and strategy.

As long-term investors, we consider short-term price volatility as an opportunity and high price valuations as risk. As investors select more aggressive portfolios, investment outcomes become less predictable. Another element of portfolio risk that is important to investors is the possibility of experiencing negative returns. This makes clear that investors should approach ongoing portfolio reviews with the idea of focusing primarily on the portfolio as a whole rather than the individual components that make up the portfolio which will experience losses from time to time.

To lower portfolio expenses, we also utilize individual stocks, individual bonds and exchange-traded funds for a portion of the pure equity and fixed income classes, then apply macro and fundamental analysis to overweight countries, sectors or yield curve segments. However, the methodology of using passive, lowest cost exchange traded solutions must be executed with prudence. We deem the blind use of ETF passive benchmarks to be inherently dangerous since engaging in 'herd behavior' often leads to holdings of the most 'trendy' companies, which may have absurd market values relative to the intrinsic fundamental value. For example, on March 31, 2000, "five of the top thirty stocks had a P/E (ratio) higher than 100, and nine more had a P/E between 50 and 100. The market capitalization (value) of the 14 largest companies with P/Es higher than 50 summed $3.2 trillion. . by September 30, 2002, the capitalization of the 14 largest companies had fallen by $2.5 trillion as part of an overall equity market decline that trimmed more than $6 trillion from the total US equity capitalization." (The Research Foundation of AIMR, Benchmarks and Investment Management, Laurence B. Siegal, 8/1/03. p. 37). This event illustrates the need for active management of asset classes - in this case, banking gains from equities by means of rebalancing toward other asset classes. Finally, we also take account and try to control for other ETF risk considerations such as liquidity, authorized participants mechanism issues, tax inefficiencies, etc.

A primary reason advisors are also including some liquid tradable alternative strategies (e.g. REITs, option protection, absolute strategies) in their clients’ portfolio is that they broaden diversification and give investors a risk/return profile different from that provided by equities, bonds or cash. We look at alternatives as portfolio diversifiers because they don’t have a high correlation with stocks or bonds and fit somewhere between the two in terms of risk profile. Another consideration is to evaluate the increased portfolio contribution of alternative assets when traditional assets like stocks and bonds are trading at lofty valuations.

In an effort to offset the costs of alternative styles, we also employ dynamic passive investment methods for the pure equity allocations via exchange traded funds or ETF (average expense 0.15%-0.25% or 15-25 basis points), along with buying individual stocks, diverse individual bonds, preferred issues, etc. With ETFs, we can choose between over 100 styles of ETF equity indices (focus on liquidity) and construct a portfolio that integrates a low-covariance between classes. We further optimize mean-variance with fixed income (TIPS, Corporate & Government bonds) and hybrid fixed income exposure (convertible, high-yield & mezzanine debt). So we’re emphasizing using various alternative strategies to help us manage risk.

These two matrix charts show the immense asset diversity potential:

What is revealing about the top chart "Total Returns by Asset Class Rankings" is the asset-type performance leaders change and in any given year, some asset classes will outperform another. Unfortunately, no amount of skill or experience has enabled anyone to forecast how various asset classes will stack up in any of those given years. And as a result, those who try to predict and time the markets usually underperform. On its own, each asset class can be quite volatile, but a mix of assets in a balanced portfolio can lower overall volatility. The key is to diversify across asset classes that behave differently across economic environments. In general, equities do well in high growth and low inflation environments, bonds do well in deflationary or recessionary environments, and commodities/hard assets tend to perform best during inflationary environments. We focus on having a balanced exposure to these three main principles in order to produce more consistent long-term results, which at times, may hold different assets during different economic cycles.

The following graph illustrates return relative to risk, in the form of standard deviation. Within a two asset world of stocks and bonds, there is a tradeoff between return and risk, which each unique client may fall within for the optimal portfolio allocation. The difference is we work with many more diverse asset classes.

The same principle is applied within a diverse multi-asset framework, having an optimal combination of many different asset classes with their own unique historical returns and risks. For example, the following displayed assets would be applied to the optimal portfolio allocation frontier shown in the above illustration.

There's an old adage in investment finance: "Do you want to be right, or do you want to make money?" If you're in the punditry business then all that matters is saying "you were right," while often overlooking all the times you were wrong. Successfully managing money is different. We are not oracles nor do we have a crystal ball, but we do have tools to help manage investment allocations: economic data, valuations, fed policy and guidance, global stability, etc. Hence, rather than attempting "to be right," we focus on reasonable portfolio returns and believe it's far more efficient to mitigate risk with diverse asset classes.

As an institutional custody affiliate of Charles Schwab, our services provide for full transparency, 24/7 online client access, safe asset custody, third-party statement reporting and a low fee-oriented platform.

Contact us for a complimentary initial consultation & portfolio review: 805-965-7955 | Email: [email protected]

Investment Managers & Money Managers serving San Luis Obispo County, Santa Barbara County, Ventura County, Los Angeles County & Orange County

Disclaimer: The website provides general information regarding our business along with access to additional investment related information. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. The intent is to provide helpful information, which should NOT be construed as investment advice. We do not guarantee its accuracy, nor completeness, and it is not intended to be the primary basis for investment decisions. We do not make personal investment recommendations to people or entities except to those who have engaged us expressly for the purpose of providing professional investment advisory services. Montecito Capital Management Group’s ADV filing is available online at http://www.adviserinfo.sec.gov and current FORM ADV Part 2, which describes the services offered, fees charged and detailed company information, among other things, is available upon request free of charge. We are limited in our fiduciary capacity by the firm's non-discretionary client relationship, whereby the client dictates the investment parameters and contractually agrees to accept sole responsibility for their choices.

As an institutional custody affiliate of Charles Schwab, our services provide for full transparency, 24/7 online client access, safe asset custody, third-party statement reporting and a low fee-oriented platform.

Contact us for a complimentary initial consultation & portfolio review: 805-965-7955 | Email: [email protected]

Investment Managers & Money Managers serving San Luis Obispo County, Santa Barbara County, Ventura County, Los Angeles County & Orange County

Disclaimer: The website provides general information regarding our business along with access to additional investment related information. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. The intent is to provide helpful information, which should NOT be construed as investment advice. We do not guarantee its accuracy, nor completeness, and it is not intended to be the primary basis for investment decisions. We do not make personal investment recommendations to people or entities except to those who have engaged us expressly for the purpose of providing professional investment advisory services. Montecito Capital Management Group’s ADV filing is available online at http://www.adviserinfo.sec.gov and current FORM ADV Part 2, which describes the services offered, fees charged and detailed company information, among other things, is available upon request free of charge. We are limited in our fiduciary capacity by the firm's non-discretionary client relationship, whereby the client dictates the investment parameters and contractually agrees to accept sole responsibility for their choices.